Do analysts who work for hedge funds make good calls? In their November 2011 paper entitled “Do Buy-side Recommendations Have Investment Value?”, Steven Crawford, Wesley Gray, Bryan Johnson and Richard Price III profile analysts employed by mutual funds, hedge funds and other investment firms and examine whether these experts make good trading recommendations. Using personal data and 2,135 long and short U.S. common stock investment propositions from over 1,100 participants in the SumZero community of buy-side investment professionals (mostly associated with hedge funds) during March 2008 through December 2010, and contemporaneous institutional holdings from SEC Form 13F filings, they find that:

- Among SumZero participants reporting relevant personal data: 42% are based in New York; almost a quarter attended a top ten university (5% graduated from Harvard); and, average (median) investment experience is 8.3 (7.0) years.

- They focus on opportunities in North America, with western Europe a distant second. About a quarter list “value” or “deep value” for investing style, and the average book-to-market ratio for long (short) investment propositions is 0.96 (0.51).

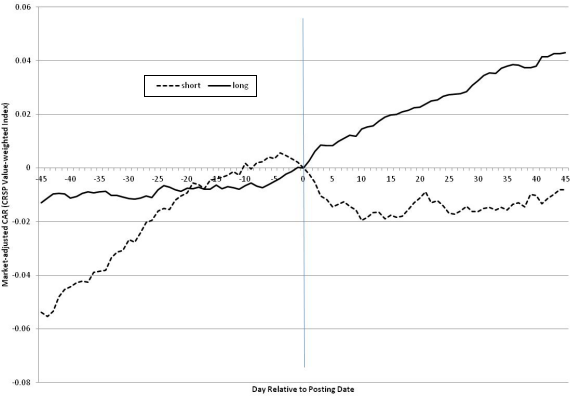

- Cumulative abnormal (market-adjusted) returns (CAR) around posting of investment propositions on SumZero are as follows (see the chart below):

- From posting date through nine subsequent trading days, long recommendations generate an average CAR of 1.44%, followed by a persistent upward drift. From posting date through 44 subsequent trading days, long recommendations generate an average CAR of 4.03%. Returns to long recommendations concentrate in relatively small firms, and drift concentrates in firms with high book-to-market ratios.

- From posting date through nine subsequent trading days, short recommendations generate an average CAR of -1.95%, with no ensuing drift. During the 45 trading days before posting, average CAR for short recommendations is 5.38%, suggesting bets against recent winners.

- Contemporaneous changes in aggregate institutional holdings and in the holdings of employers of SumZero posters suggest a persistent transfer of wealth from the former to the latter.

The following chart, taken from the paper, plots average CARs for the sampled SumZero long and short investment propositions from 45 trading days before through 45 trading days after posting. Results indicate that market reactions reflect: (1) for long propositions, posting-stimulated recognition of undervaluation with persistent momentum; and, (2) for short propositions, posting-stimulated recognition of overvaluation but no momentum.

In summary, evidence suggests that SumZero participant long (short) investment propositions have intermediate-term (short-term) value.

Note that individual investors can currently get free but limited access to SumZero ideas.

Cautions regarding findings include:

- Reported returns are gross, not net. Including reasonable trading frictions would reduce them.

- Any lag in following posted propositions would inhibit exploitation, especially for short recommendations.

- If the most profitable postings tend to cluster calendar-wise (during exceptionally favorable market conditions), capital deployment issues may limit portfolio-level exploitation (due to dry spells and missed opportunities).

Compare findings with those summarized in “Professional Investor Groups Sharing Value (or Moving Markets)”.