Was John Maynard Keynes, famous for contributions to macroeconomic hypotheses, a superior investor? In their March 2012 paper entitled “Keynes the Stock Market Investor”, David Chambers and Elroy Dimson evaluate the investment philosophy, strategies and performance of John Maynard Keynes based on his discretionary trading for the King’s College endowment (and, by similarity, for his own account). A key performance measure they apply is buy-and-hold abnormal return (BHAR), defined for each security as the geometric difference between the security’s cumulative total return over a specified interval and the cumulative beta-adjusted return on the market over the same interval. They combine BHARs for individual securities by averaging (equal weighting). Using King’s College endowment annual investment reports (including lists of holdings) and transaction records (567 buys and 387 sells) for portfolios managed at Keynes discretion for fiscal years 1924 through 1946 (ending in August), along with associated security prices/dividends and estimated UK market index levels, they find that:

- Keynes is a leader among institutional investors in making substantial allocations to common stock (displacing real estate, fixed income securities and cash). His portfolio averaged over 74% allocation to UK and U.S. common stocks over the sample period, with the plurality of the balance in UK preferred stocks.

- Over the entire sample period, his portfolio (the UK equity index) has an average gross annual return of 15.2% (8.1%) per year, with annual Sharpe ratio 0.69 (0.38). His tracking error versus the UK equity index is a very active 12.6%.

- He underperforms in five of 22 years, mostly in the early part of the sample period and fails to foresee the market crash of late 1929, such that his inception-to-date performance relative to the UK equity index reaches -17.4% by August 1930. During this time, he appears to focus on market timing based on top-down (macroeconomic) conditions.

- However, after 1930, he underperforms the UK equity index substantially only once (in 1938) and never trails this benchmark on a rolling three-year or five-year basis. He attributes this later success to long-term investments in a few core holdings cheap relative to their intrinsic values (bottom-up stock picking).

- He concentrates UK equity holdings in two sectors (commercial and industrial, and metal mining), with clear tilts towards mid-cap and small-cap stocks. His annual turnover of UK equities averages 28% during 1924-29, 31% during 1930–39 and 11% during 1940–46.

- His approach to equity valuation is innovative, estimating (for example) the value of Austin Motor shares in terms of both earnings yield and market capitalization per car produced versus General Motors. He very likely had private (insider) access to what today would be deemed price-sensitive information.

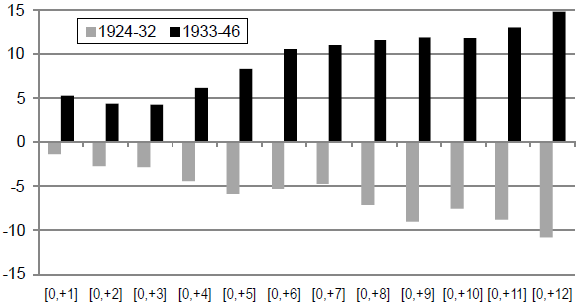

- His short-term trading performance is very strong, generating double-digit returns for stocks held for only one or two months. His performance for stocks held longer than two months is, as indicated above, weak early in the sample period but strong later (see the chart below).

The following chart, taken from the paper, summarizes post-purchase average (equal weighting) BHAR for stocks bought by Keynes and held for two to 12 months during 1924-1932 and during 1933-1946. The early underperformance and late outperformance of his equity investments correspond to a shift in strategy from market timing based on macroeconomic conditions to stock picking based on firm valuation.

In summary, evidence indicates that John Maynard Keynes was consistently a good short-term stock trader. At intermediate-term and long-term horizons, his early investing performance as a macroeconomic timer is weak, while his later performance as a stock picker is strong.

As quoted in the paper, Keynes summarizes: “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.”

Cautions regarding findings include:

- Return measurements are apparently gross, not net. Including trading frictions would reduce returns.

- In the context of secular trends and annual performance measurement, subsamples of nine and 14 years are not long.

Compare the evolved philosophy of Keynes with that summarized in “Warren Buffett on Investing”.