Do economic indicators usefully predict government bond returns? In the January 2014 version of their paper entitled “What Drives the International Bond Risk Premia?”, Guofu Zhou and Xiaoneng Zhu examine whether OECD-issued leading economic indicators predict government bond returns at a one-month horizon. They focus on a four-country (U.S., UK, Japan and Germany) aggregate leading economic indicator (LEI4). They test whether LEI4 outperforms historical averages and individual country LEIs in predicting term premiums (relative to a one-year bond) for U.S., UK, Japanese and German government bonds with terms of two, three, four and five years. Their test methodology employs monthly inception-to-date regressions of annual change in LEI4 versus next-month bond return for an out-of-sample test period of 1990 through 2011. Using end-of-month total return data for 1-year, 2-year, 3-year, 4-year and 5-year government bonds since 1962 for the U.S., 1970 for the UK, 1980 for Japan and 1975 for GM, all through 2011, they find that:

- Over the respective country sample periods, average annual government bond term premiums range from 0.48% for 2-year U.S. government bonds to 2.2% for 5-year Japanese government bonds. Premiums for government bonds with 2-year to 5-year terms are highly variable.

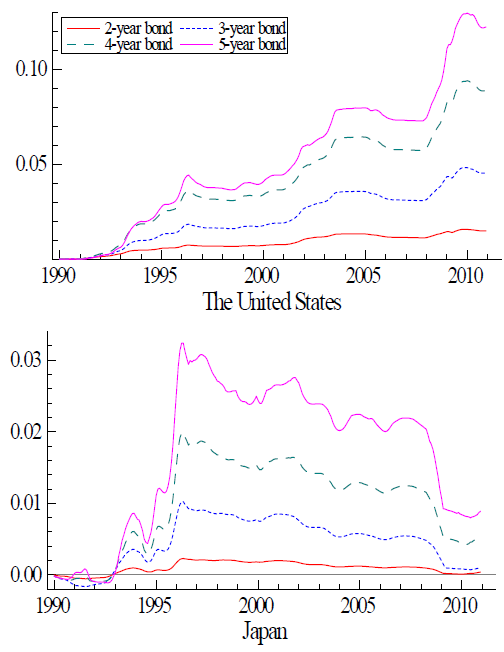

- An LEI4 regression generally outperforms the historical average in predicting government bond term premiums (see the chart below). This outperformance is much stronger for U.S. and UK bonds than for German and (especially) Japanese bonds.

- Local country LEIs strongly underperform (modestly outperform) LEI4 in predicting U.S. and UK (German and Japanese) bond term premiums.

- Applied to timing of simple bond portfolios (each comprised of a one-year “risk-free” bond and one longer-term bond), LEI4 government bond premium forecasts offer average gross annual economic utility gains of about 0.58%, 1.0%, 0.14% and 0.10% for U.S., UK, German and Japanese bonds, respectively.

- LEI4 generally outperforms other complex government bond term premium predictors.

- Subsample results are broadly consistent with those for the full sample. Forecasts at a six-month horizon are generally weaker than those at a one-month horizon.

The following charts, taken from the paper, show cumulative differences during 1990 through 2011 in government bond term premium squared prediction errors between an historical average benchmark and the above LEI4 model for 2-year, 3-year, 4-year and 5-year term U.S. (upper chart) and Japanese (lower chart) bonds. When a curve rises (falls) LEI4 is outperforming (underperforming) a prediction based on the historical average.

Results suggest that LEI4 beats the historical average as a U.S. government bond premium predictor much of the time, with outperformance perhaps concentrating during economic recessions. However, LEI4 largely underperforms the historical average in the Japanese government bond market since 1996.

The paper has comparable charts for UK and German bonds.

In summary, evidence suggests that government bond term premiums for major economies (especially the U.S. and the UK) have global dependencies, such that a global aggregate of leading economic indicators may usefully predict them.

Cautions regarding findings include:

- The authors take a much more academic than practical approach. They do not discuss the direction of the LEI4-bond term premium relationship. Presumably, an increase (decrease) in LEI4 indicates higher (lower) interest rates and lower (higher) bond prices, but the combined price-yield relationship may be complex.

- The sample is not long in terms of number of economic cycles.

- Estimates of the utility gains from timing government bond allocations based on LEI4 are gross, not net. Including costs of portfolio rebalancing would reduce these gains.

- Inconsistencies in LEI4 predictive performance over time and across countries undermines belief in its reliability.

- Testing across country samples, country LEIs/LEI4 and bond terms introduces data snooping bias, such that the strongest results tend to overstate reasonable expectations.

- The authors appear to account for the OECD LEI publication delay of five to six weeks after month-ends, but they do not explicitly address this delay.