Does using after-tax, rather than pre-tax, returns make a big difference in allocating assets based on mean-variance optimization? In their June 2014 paper entitled “What Would Yale Do If It Were Taxable?” Patrick Geddes, Lisa Goldberg and Stephen Bianchi illustrate a three-step approach for adapting the Yale Endowment for investors obligated to pay U.S. taxes:

- Reverse engineer Yale Endowment allocations by applying covariances of matched benchmark indexes to derive implied pre-tax asset class returns.

- Apply assumptions about taxes to convert the pre-tax returns to after-tax returns.

- Apply mean-variance optimization to after-tax returns to calculate optimal allocations based on after-tax returns.

The asset classes addressed are: absolute return (hedge funds), equity (U.S. and global combined), bonds, natural resources, real estate, private equity and cash. For estimating tax impacts, the authors assume: returns from bonds and cash are ordinary income; there are distinct tax obligations for returns from active, passive (index fund) and tax loss-advantaged equity; hedge fund returns are tax-wise similar to active equity; 30% of appreciation from natural resources and private equity are realized each year as long-term gains; and, 30% of appreciation from real estate are realized each year as ordinary income. They ignore any effects of portfolio liquidation. Using Yale Endowment allocations and U.S. tax rules as of the end of 2013, along with benchmark index covariances during December 1998 through June 2013, they find that:

- Reverse engineering indicates Yale Endowment asset class pre-tax return estimates ranging from 1.5% for bonds and cash to 12.3% for real estate (with the hedge fund class a surprisingly low 2.2%).

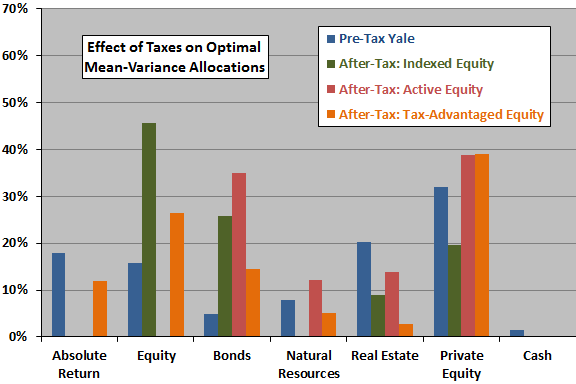

- Accounting for taxes tends to shift allocations from tax-inefficient asset classes, such as hedge funds, to tax-efficient classes, such as private equity (see the chart below).

- Results are particularly sensitive to decisions on: (1) how to invest in stocks (active, index fund or tax-advantaged); and, (2) which hedge fund index to use as a benchmark for the absolute return class.

The following chart, constructed from data in the paper, compares the following four mean-variance optimal allocations:

- Pre-Tax Yale – as published by the Yale Endowment as of the end of 2013.

- After-Tax: Indexed Equity – based on holding equity via index funds, thereby avoiding capital gain taxes.

- After-Tax: Active Equity – based on active equity trading, with capital gains tax impacts estimated from shareholder distribution data for active U.S. equity funds over the 18 years ending June 2013 (76% of capital gains distributed).

- After-Tax: Tax-Advantaged Equity – based on active equity trading with tax loss harvesting to offset gains elsewhere.

Results show that optimal mean-variance allocations differ across the four portfolios, with taxes shifting allocations considerably toward low-tax assets.

In summary, modeling indicates that accounting for differences in tax rates across asset class proxies substantially affects mean-variance optimal allocations.

Alternatively, results indicate how sensitive mean-variance optimal allocations are to estimates of future asset returns.

Cautions regarding findings include:

- The specified benchmark indexes may not accurately mimic Yale Endowment asset classes (for example, the Russell 2000 Index for Private Equity).

- As noted in the paper, using different benchmark indexes (especially for hedge funds) or different historical sample periods for calculating asset covariances may alter findings.

- Changes in assumptions about realized versus unrealized and short-term versus long-term asset class gains affect findings. As noted in the paper, tax obligations are materially personal, so the quantitative results are illustrative only.

- There may be feedback from historical tax rates to historical benchmark covariances. In other words, future tax rates may in themselves make future covariances different from past ones.