How can investors protect portfolios from crashes across asset classes? In the November 2014 version of his paper entitled “Tail Risk Protection in Asset Management”, Cristian Homescu describes tail (crash) risk metrics and summarizes the body of recent research on the effectiveness and costs of alternative tail risk protection strategies. The purpose of these strategies is to mitigate or eliminate investment losses during rare events adverse to portfolio holdings. These strategies typically bear material costs. He focuses on some strategies that may be profitable and hence useful for more than crash protection. Based on recent tail risk management research and some examples, he concludes that:

- Widely used measures of (left) tail risk are:

- Downside volatility – the standard deviation of negative returns.

- Value-at-risk – the probability over a given interval of a loss greater than some threshold.

- Expected shortfall or conditional value-at-risk – the expected total for events exceeding the VaR threshold.

- Value of financial derivatives that hedge negative returns.

- Expected tail loss – expected return during the worst events over a specified interval.

- Tail risk protection must work (meaningfully offset losses and not quickly revert) when asset allocation, rebalancing and momentum strategies are most vulnerable (when the market is least liquid).

- Tail risk strategies fall into four categories:

- Diversification – not all holdings crash at the same time. However, diversification that is evident when markets are calm may diminish during crises.

- All-weather (such as risk parity) – markets have two or several predictable states (regimes), with each state having a distinct return distribution and inter-asset correlations. However, regime prediction is messy, making the portfolio suboptimal most of the time.

- Hedging – sacrifice a portion of expected returns to fund positions (portfolio insurance) that protect the balance of the portfolio during tail events. Portfolio insurance may be static or dynamically change based on market state. Cost effectiveness is a main concern. Complexity is a concern for dynamic hedging.

- Alternative alpha – elevate allocations to alternative investments (global macro, Commodity Trading Advisor and volatility-based) expected to outperform during volatile markets. However, such alternatives may be a drag on the overall portfolio much of the time.

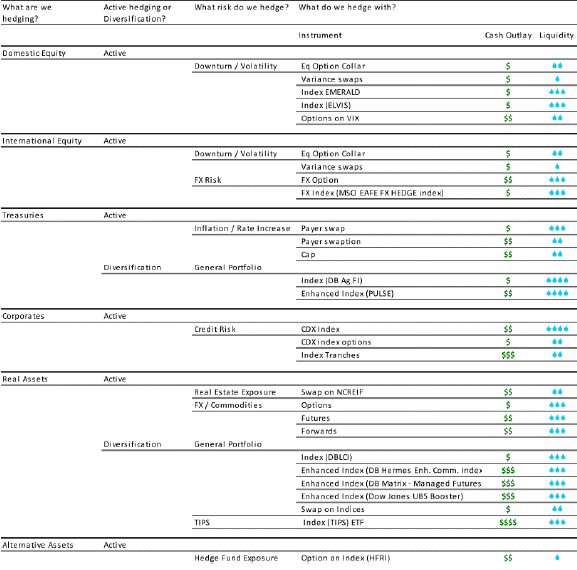

- Hedging approaches may involve one or more of (see the table below):

- Variance swaps

- Tail risk protection indexes

- Financial options

- Credit instruments

- Inflation floor agreements

- Managed futures indexes

- Sovereign risk commodity hedges

- Sovereign risk rates hedges

- Swaps on indexes

- A target volatility strategy

- A tail risk parity strategy

- Exploitation of implied and/or realized volatility

- Dynamic hedging strategies (such as a multi-regime volatility futures strategy) may boost long-term portfolio returns both by generating positive returns and by making funds available during hedge liquidation to exploit low prices for hedged assets.

The following table, extracted from the paper, summarizes instruments available to hedge tail risks for various asset classes, along with rough relative hedge costs and liquidities.

In summary, evidence suggests that tail risk management improves long-term portfolio performance even for well-diversified investors.

Cautions regarding conclusions include:

- By definition, samples of rare events are always small. Optimizing complex tail protection strategies with many assumptions/parameters using small samples can generate extreme data snooping bias.

- Moreover, comparing different strategies for avoiding a given type of crash incorporates higher-level snooping bias.

- As noted in the study, some hedging instruments may involve ancillary risk of hedge counterparty failure.