Do country stock markets act like individual stocks with respect to return for risk taken? In his December 2014 paper entitled “Is There a Low-Risk Anomaly Across Countries?”, Adam Zaremba relates country stock market performance to four market risk metrics: beta (relative to the capitalization-weighted world stock market), standard deviation of returns, value at risk (fifth percentile of observations) and idiosyncratic (unexplained by world market) volatility. He uses historical intervals of 12 to 24 months as available to estimate risk metrics. He then forms capitalization-weighted portfolios of country markets by ranking them into fifths (quintiles) based on risk metric sorts. He also investigates whether risk/size and risk/book-to-market ratio double-sorts enhance country-level size and value effects. Using monthly returns and accounting data for 78 existing and discontinued country stock market indexes in U.S. dollars during February 1999 through September 2014, he finds that:

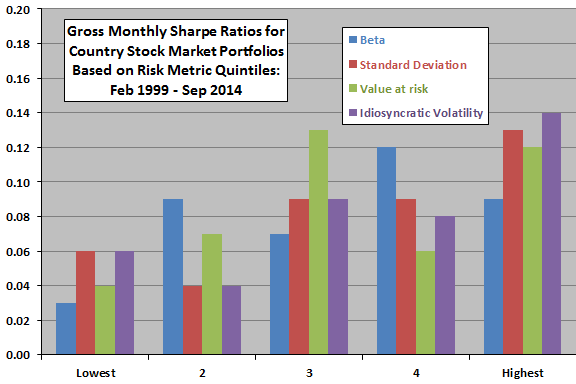

- Portfolios of high-risk stock markets tend to have higher average gross returns and gross Sharpe ratios than portfolios of low-risk markets (see the chart below). Results appear strongest for standard deviation and idiosyncratic volatility.

- Country-level size, value and momentum effects jointly explain most of these risk effects (four-factor model alphas are not statistically significant).

- An additional sort on value at risk markedly enhances country-level size and value effects.

The following chart, constructed from data in the paper, shows gross Sharpe ratios by quintile of country stock markets sorted on the above four measures of risk. Results generally support a belief in reward-for-risk and not any low-volatility effect.

In summary, evidence suggests that high-risk country stock markets offer more, not less, reward than low-risk country stock markets.

Cautions regarding findings include:

- The sample period is not long in terms of number of economic/market cycles.

- As noted in the paper, the sample of countries is not large.

- Use of index returns ignores any costs of maintaining a liquid tracking fund. These costs would lower reported returns.

- Moreover, as noted in the paper, quintile portfolio performance ignores trading frictions and tax implications of monthly reformation (and shorting costs for long-short portfolios). These costs may be high for some markets.

- Use of multiple metrics to measure risk introduces snooping bias, such that the most effective metric likely overstates expected performance.