Are there gradual steps toward a fundamental stock index that work just as well? In their April 2015 draft paper entitled “Decomposing Fundamental Indexation”, Gregg Fisher, Ronnie Shah and Sheridan Titman compare fundamental indexing strategies to strategies that tilt a market index toward high fundamental-to-price stocks. Fundamental indexing strategies weight stocks by firm fundamentals instead of market capitalizations, ignoring any information in stock prices. The tilt strategies adjust market weights with multipliers linearly scaled to fundamental-to-price ratios across a universe of stocks. Reflecting extreme fundamentals ratios for smaller stocks, the range of multipliers for stocks in the upper (lower) half of market capitalizations is 0 to 2 (0 to 4). After applying multipliers, tilt the strategies normalize weights so that they sum to 100%. Rebalancing for all portfolios is annual on the last day in April, incorporating a minimum four-month lag between the end of the financial reporting period and portfolio formation. Using data for a broad sample of U.S. common stocks during May 1975 through December 2014, they find that:

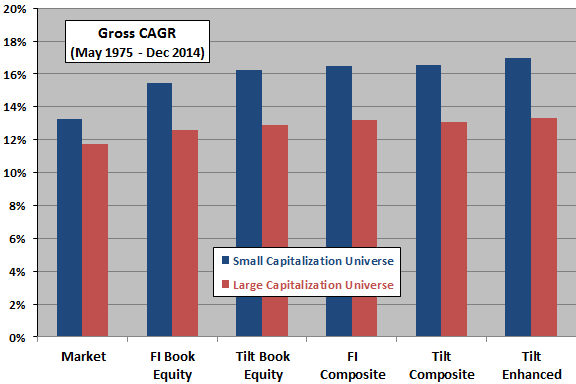

- Tilt portfolios generate returns, volatilities and turnovers at least as attractive as those of corresponding fundamentally indexed portfolios (see the chart below).

- Tilt portfolios track capitalization-weighted benchmarks more closely than fundamentally indexed portfolios by deviating from capitalization weights only when prescribed by the value metric.

- For both tilt portfolios and fundamentally indexed portfolios, a combination of value metrics outperforms a single book value metric.

- Value tilt portfolios that incorporate non-value factors (profitability, asset growth and momentum) outperform those based only on value, with somewhat lower turnovers.

The following chart, constructed from data in the paper, summarizes gross CAGRs over the entire sample period for 12 portfolios, one set for a small-capitalization universe (comparable to the Russell 2000) and another set for a large-capitalization universe (comparable to the Russell 1000). The six strategies considered for each universe are:

- Market – capitalization-weighted.

- FI Book Equity – fundamentally indexed with weights based on book equity per share.

- Tilt Book Equity – tilted as described above based on book equity per share.

- FI Composite – fundamentally indexed based on average weights implied by book equity, five-year average revenue, operating income before depreciation and dividend per share.

- Tilt Composite – tilted based on average percentile ranks of the four fundamentals scaled by price to construct the multiplier.

- Tilt Enhanced – tilted with a multiplier based on percentile ranks of value (book equity/price), return on assets and asset growth, with rebalancing conditioned by a momentum signal. If the multiplier increases (decreases), rebalancing to the new multiplier occurs only if the momentum percentile is greater (less) than 50%.

Results indicate that, on a gross basis, tilt strategies work at least as well as fundamental indexing. Turnovers are mostly a little lower for tilt strategies than for fundamentally indexed counterparts, and tracking errors relative to benchmarks are substantially lower.

In summary, evidence indicates that tilting market capitalization weights based on value metrics is in some ways better at capturing value premiums than fundamental indexing, most noticeably for a small-capitalization stock universe.

Cautions regarding findings include:

- Reported returns are gross, not net. Incorporating portfolio rebalancing frictions would reduce these returns. Reductions for the small-capitalization universe would be greater than those for the large-capitalization universe due to higher turnovers and higher per-trade frictions.

- Testing several strategies on the same data introduces snooping bias, such that the best performances likely overstate expectations. There may be incremental snooping bias from:

- Selection of value metrics used (derived from snooping in prior research).

- Development of the weighting scheme for tilt portfolios.

- Development of ways to combine value metrics and to combine value and non-value metrics.

- Data/processing requirements and portfolio breadths are beyond the reach of many investors, or costly via fees if delegated to a fund manager.