Does firm news reliably interact with stock return anomalies? In their July 2015 paper entitled “Anomalies and News”, Joseph Engelberg, David McLean and Jeffrey Pontiff compare anomaly returns on days with and without firm-specific news releases. They consider 97 anomalies published in 80 academic papers. For some analyses, they segregate these anomalies into four categories: (1) firm event-related (such as stock issuance); (2) market (such as momentum); (3) valuation (such as earnings-price ratio); and, (4) fundamental (such as acruals). They measure each anomaly using the extreme fifths (quintiles) of monthly stock sorts to specify a long side and short side. They calculate returns in three-day intervals around news days. Using stock and firm data required to construct anomaly portfolios, 489,996 earnings announcements and 6,223,007 Dow Jones news items during 1979 through 2013, they find that:

- 1.2% of all firm-day observations have have earnings releases, and 16% have Dow Jones news stories (with overlap).

- Across all anomalies, average return is seven times higher on earnings release day and two times higher on other firm news days.

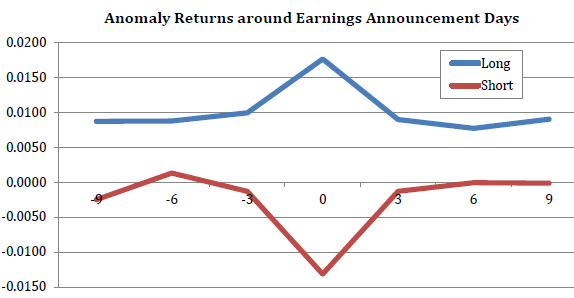

- The effect holds for both the long and short sides. On average across all anomalies:

- On earnings release day, return is 5.5 (10) times higher for the long (short) side.

- News days account for 80.1% (84.8%) of total long (short) side return.

- Across anomaly categories:

- Market anomalies exhibit the highest (lowest) sensitivity to non-earnings (earnings) news.

- Fundamental anomalies exhibit the lowest (highest) sensitivity to non-earnings (earnings) news.

- Findings are robust to adjustments for risk exposure and for data snooping.

The following chart, taken from the paper, presents typical long-side and short-side anomaly returns for seven 3-day windows around earnings announcements. Results indicate that earnings releases amplify returns in the direction indicated by anomaly specification.

Since earnings release days are generally known in advance, investors may be able to exploit these tendencies.

In summary, evidence indicates that a large fraction of stock anomaly returns tends to concentrate around news, especially earnings releases.

Cautions regarding findings include:

- Return calculations are gross, not net. Capturing these return concentrations would require considerable trading focused on predictable news (earnings releases) for stocks screened monthly on anomaly variables.

- Much news is unpredictable and associated return concentrations largely unexploitable.

- Reliable exploitation requires considerable data acquisition/processing and many positions. Investors delegating these tasks to managers would bear fees.