Does the Christmas holiday, a time of putative good will toward all, give U.S. stock investors a sense of optimism that translates into stock returns? To investigate, we analyze the historical behavior of the S&P 500 Index during five trading days before through five trading days after the holiday. Using daily closing levels of the S&P 500 Index for 1950-2022 (73 events), we find that:

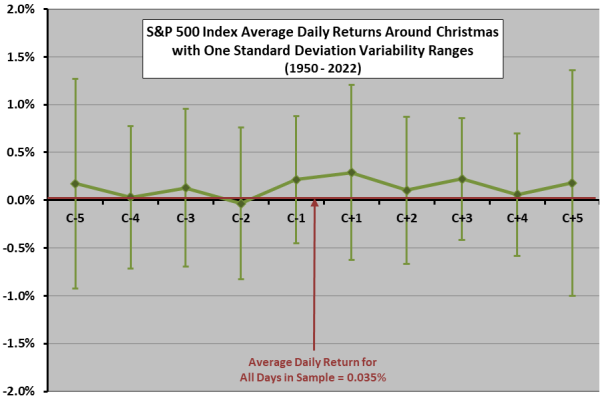

The following chart shows average daily S&P 500 Index returns for five trading days before (C-5 to C-1) through five trading days after (C+1 to C+5) Christmas over the full sample period, with one standard deviation variability ranges. The average daily return for all trading days in the sample is 0.035%.

Results on average suggest abnormal strength from the trading day just before through a few days after Christmas. As usual for daily data, noise generally dominates signal.

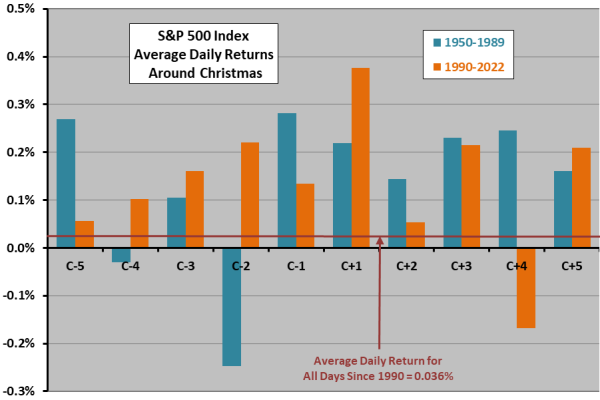

To check the reliability of the post-holiday strength, we look at two subsamples.

The next chart compares average daily returns for five trading days before and after Christmas for two subsamples: 1950-1989 (40 events), and 1990-2022 (33 events). This chart has no variability ranges and uses a finer vertical scale than the preceding one. The subsamples mostly confirm strength just before the holiday and for a few days after, but subsample behaviors do differ.

In summary, best guess is that any anomalous U.S. stock market strength around Christmas will start one trading day before and persist for a few trading days after the holiday, but noise generally dominates.

Cautions regarding the finding include:

- As noted, any return anomaly is small compared to return variability, so experience by year varies widely.

- To the extent that the distribution of daily S&P 500 Index returns is wild, interpretation of the average return and standard deviation of returns breaks down.