Do mutual fund investors in aggregate exhibit good, bad or indifferent market timing? In their January 2011 article entitled “Past Performance is Indicative of Future Beliefs”, Philip Maymin and Gregg Fisher investigate how the aggregated timing of buying and selling by mutual fund investors affects their average returns. Using monthly returns and assets for approximately 25,000 mutual funds over the period November 1995 through October 2010, they find that:

- Over the entire sample period, for all types of mutual funds, the average fund investor sacrifices about 1.9% annually to poor market timing.

- This poor timing derives essentially from replacing recent underperforming funds with recent outperforming funds. For example, peak net inflows to bond funds occur after equity bear markets in 2002 and 2008-2009.

- A model assuming that a one-year “memory” of past returns triggers investor actions effectively explains the bad timing behavior.

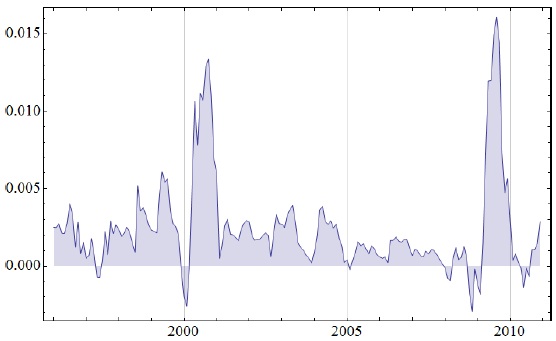

The following chart, taken from the article, plots the equally weighted average past-year behavioral cost by month (rolling past-year average fund return minus investor experienced, or asset-weighted, past-year average return) across all mutual funds in the sample. The average behavioral cost is almost always positive, meaning that investors almost always underperform the funds. Note that:

- Buy-and-hold investors do not incur this average behavioral cost.

- Contrarian investors acting inversely to net mutual fund flows (theoretically) convert average behavioral cost to personal gain. However, the chart is retrospective, and the article does not address any metrics or strategies for exploiting average behavioral cost.

In summary, evidence indicates that mutual fund investors in aggregate chase returns with a one-year “memory” and thereby materially underperform their funds.

This finding suggests that large market swings (as seen over the past decade) tend to extract high average behavioral penalties from mutual fund investors.