Should investors with different horizons prefer different styles (large versus small capitalization and value versus growth)? In their 2010 paper entitled “Time, Risk and Investment Styles”, Zugang Liu and Jia Wang investigate how equity investment style risks vary with investment horizon. They focus on the downside of asset returns rather than overall volatility to measure risk, arguing that investor risk aversion consistently relates to potential loss but not to return standard deviation. Specifically, lower partial standard deviation (LPSD) is appropriate for risk-averse investors because it assigns higher weights to greater losses, and shortfall risk is appropriate for aggressive investors because it considers only probability of loss (not size of loss). The authors use both rolling window and bootstrap methodologies to compare equity style expected shortfall and LPSD over horizons of one, five, ten, 15, 20, 30 and 40 years. Using returns for six style indexes for a broad sample of U.S. stocks (intersections of first, third and fifth size quintiles with highest and lowest book-to-market ratio quintiles) and Treasury bill yields over the period July 1926 through December 2008 (82.5 years), they find that:

- For risk-averse investors, the large-growth (small-vale) style is the safest over short (long) investment horizons.

- For aggressive investors, the small-cap value style is the safest over all investment horizons.

- The small-growth style is riskiest over all investment horizons for both types of investors.

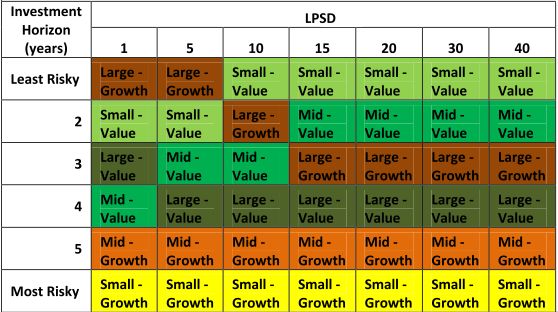

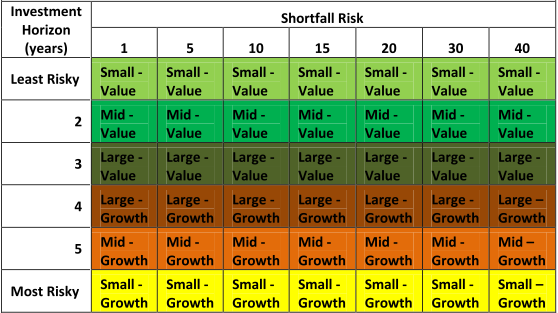

The following tables summarize riskiness by equity style and investment horizon based on the bootstrap methodology for risk-averse investors (LPSD, upper table) and aggressive investors (Shortfall Risk, lower table). For risk-averse investors, the large-growth (small-value) style is least risky for short (long) investment horizons. For aggressive investors, the small-value style is least risky for all investment horizons.

The authors provide similar results for the rolling window methodology. The most consistent finding across methodologies is that the small-growth style is the riskiest across all investment horizons.

In summary, evidence from complementary methodologies indicates that the safest (riskiest) equity styles are probably large-growth at short investment horizons and small-value at long investment horizons (small-growth at all horizons).

Cautions regarding findings include:

- Conclusions are in-sample in that they utilize the entire set of data. An investor operating in real time may have drawn different conclusions about equity style risks based on strictly historical data.

- Style performance variations may have long-term influences, such that even the apparently long sample here does not convey high reliability.