Past research indicates that returns for stocks associated with share buybacks (secondary offerings) tend to be abnormally high (low) in subsequent years, suggesting that management successfully times the market and investors respond slowly to the timing signal. Do these findings persist in recent data? In their June 2011 paper entitled “The Persistence of Long-Run Abnormal Stock Returns: Evidence from Stock Repurchases and Offerings”, Fangjian Fu, Sheng Huang and Hu Lin extend this research to recent years based on three widely used abnormal stock return estimation methods applied to holding periods of 24, 36 and 48 months. They define recent years as 2003-2008. Using data for 13,992 open market stock repurchases during 1984-2008 and 5,917 seasoned equity offerings (SEO) during 1980-2008, they find that:

- In agreement with past studies, long-run gross abnormal returns are significantly positive (negative) for stocks associated with repurchases (SEOs) through 2002. Specifically, during the three years after announcement, repurchase (SEO) stocks average roughly 10% (-12%) gross abnormal returns.

- However, these gross abnormal returns disappear in the 2003-2008 subsample, comprising 3,227 stock repurchases (23.1% of the total sample) and 855 SEOs (14.5% of the total sample).

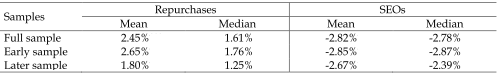

- Changes in immediate investor reaction to buyback/secondary announcements are weaker in the recent subsample (see the table below) and thus do not explain disappearance of long-term gross abnormal returns.

- Whether measured by industry-adjusted book-to-market ratios or lagged stock returns, market timing diminishes as a motivation for repurchases and SEOs in the recent subsample. Instead, cash management appears increasingly important as a reason for stock float adjustments.

- High institutional ownership significantly mutes gross abnormal returns associated with stock repurchases and SEOs. Before (after) the end of 2002, 34% (70%) of repurchase firms and 23% (57%) have greater than 50% institutional ownership, suggesting that increased institutional ownership helps explain disappearance of abnormal returns.

The following table, taken from the paper, reports mean and median three-day gross cumulative abnormal returns from one trading day before through one trading day after repurchase and SEO announcements for the full samples and for pre-2003 and 2003-2008 subsamples. Results indicate that immediate investor response to buyback-secondary announcements is weaker for the recent subsample and that a recent change in immediate response therefore does not explain the disappearance of long-term gross abnormal returns for such stocks.

In summary, evidence from recent data indicates that long-term strategies based on abnormally strong (weak) performance of firms executing stock buybacks (secondary offerings) are no longer useful.

Cautions regarding findings include:

- Return calculations ignore trading frictions. Net returns would be marginally lower for multi-year holding periods.

- The six-year (2003-2008) recent subsample is short relative to multi-year return measurement intervals and encompasses modest variety in market conditions. Analysis of several pre-2003 subperiods for consistency may be illuminating.