Does the S&P 500 implied volatility index (VIX) exhibit systematic behaviors by day of the week, around turn-of-the-month (TOTM) or around options expiration (OE)? If so, are the behaviors exploitable? Using daily closing levels of VIX since January 1990, daily opening levels of VIX since January 1992 and daily reverse split-adjusted opening and closing levels of iPath S&P 500 VIX Short-Term Futures ETN (VXX) since February 2009, all through early July 2015, we find that:

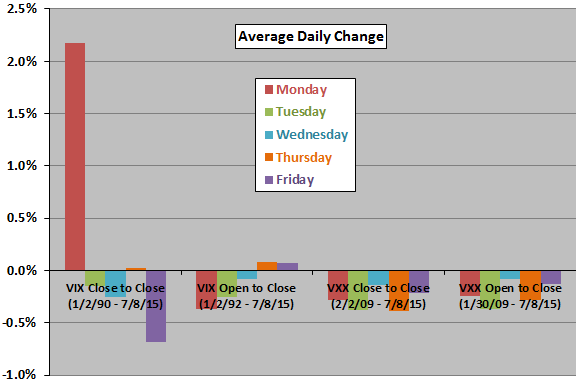

The following chart summarizes average close-to-close and open-to-close changes in VIX and VXX by day of the week over available sample periods. The most prominent anomaly is the large close-to-close average increase in VIX for Monday (from the close the prior week to the close on Monday). The overall impression is that VIX tends to fall during the week and pop back up over the weekend. However, the VXX sample (incorporating expectations of VIX futures traders) indicates that the weekend pop in VIX is not exploitable via short-term VIX futures.

What about day of the week volatility of volatility?

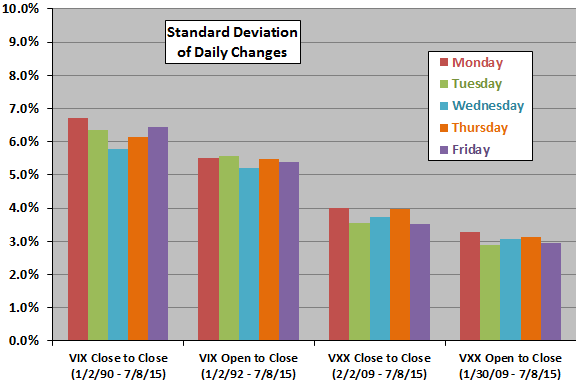

The next chart summarizes standard deviations of close-to-close and open-to-close changes in VIX and VXX by day of the week over available sample periods. Volatility of volatility does not vary much with day of the week.

VXX tends to be calmer than VIX. A test of VIX volatility since February 2009 (not shown) confirms that VXX is calmer than VIX over the subperiod since VXX inception.

What about VIX and VXX behaviors around TOTM?

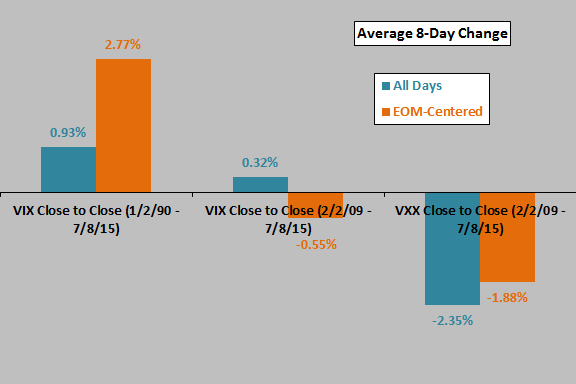

The next chart compares average close-to-close changes in VIX and VXX over all intervals of eight trading days and over intervals of eight trading days centered on the ends of the month (EOM). There are 306 EOM-centered observations for VIX and 76 for VXX. Since the TOTM interval has a relatively strong average S&P 500 Index return, one might expect an average decline in volatility. However, over the entire sample period, VIX tends to rise more during TOTM than during eight-day intervals in general. During the recent subperiod since VXX inception, VIX and VXX changes during TOTM are not notably different from those during eight-day intervals in general.

What about OE days?

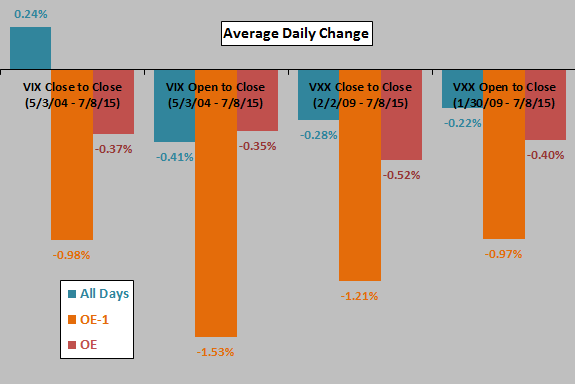

The first chart below compares average close-to-close and open-to-close changes in VIX and VXX for all days, for the day before VIX options expiration (OE-1) and for VIX options OE days since the introduction of VIX options in May 2004. OE-1 is the last day for trading before expiration. There are 130 OE observations for VIX and 77 for VXX.

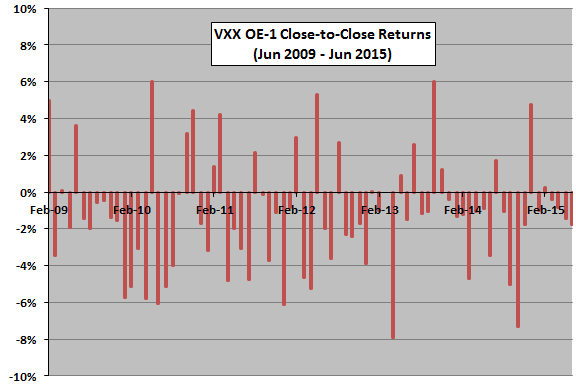

Results indicate that changes in VIX and VXX are abnormally negative for OE-1. For VXX close-to-close (open-to-close), 56 (57) of 77 OE-1 returns are negative; however, there are 4 (2) positive returns of at least 5%. The second chart below shows the time series of OE-1 close-to-close returns for VXX since its inception.

In summary, evidence from simple tests of available data suggest that one VIX short-term calendar anomaly, an average large drop on OE-1, is also an anomaly for VXX.

Cautions regarding findings include:

- The VXX sample is not large for monthly events (TOTM and OE). The VXX sample is very small in terms of number of VIX regimes.

- VXX return calculations are gross. Trading frictions diminish any exploitability.

- Testing many rules on the same data introduces snooping bias, such that the best-performing rule overstates expectations.

See also “VIX Day-of-the-Week Effects”, “VIX Behavior Around Holidays” and the statistically more tenuous “VIX-VXX Seasonality”.