Should investors diversify U.S. equity holdings with S&P 500 volatility index (VIX) futures or exchange-traded notes (ETN) constructed from these futures? In the March 2012 version of their paper entitled “Diversification of Equity with VIX Futures: Personal Views and Skewness Preference”, Carol Alexander and Dimitris Korovilas examine the performance and equity diversification power of VIX futures. They focus on ETNs with one-month constant maturity, available since January 30, 2009 as VXX (iPath S&P 500 VIX Short Term Futures), and five-month constant maturity, available since February 20, 2009 as VXZ (iPath S&P 500 VIX Mid-Term Futures). They extend these proxies back to December 2005 using matched S&P 500 VIX futures constant maturity index series and further back to April 2004 using futures price data and the Standard & Poor’s methodology. They use SPDR S&P 500 (SPY) to represent equity exposure. For diversity in equity market conditions, they consider three subperiods: April 2004 through September 2006 (tranquil); October 2006 through March 2009 (crisis); and, April 2009 through December 2011 (punctuated volatility). When examining VIX futures contract returns, they roll five days prior to maturity to avoid the effect of maturity on final settlement. Using daily data for SPY, VIX futures, VIX futures indexes, VXX and VXZ as available from March 26, 2004 (the inception of VIX futures) through December 2011, they find that:

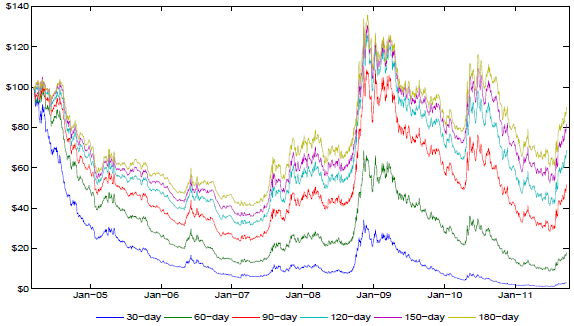

- Because the VIX term structure (slope of prices) is steeper for nearer maturities, the generally negative roll-yield effect is larger for the VXX than VXZ (see the chart below). Since the beginning of April 2009 (shortly after introduction of the ETNs), cumulative returns on VXX and VXZ are -92% and -46%, respectively.

- Recent data indicate average holding times for VIX futures ranging from just over a week for short-term contracts to about a month for long-term contracts, with bid-ask spreads in the range 0.25% to 0.35%. The bid-ask spread for VXX is in the range 0.1% to 0.2%, except for a spike over 0.4% during the Eurozone crisis in 2011.

- Realistic out-of-sample approaches to volatility diversification beat an equity-only portfolio only during the middle subperiod (during the financial crisis). In other words, near perfect foresight regarding returns on VIX futures is necessary for consistently successful volatility diversification.

The following chart, taken from the paper, tracks the gross cumulative values of $100 initial investments in the S&P 500 VIX futures constant maturity indexes, constructed by combining returns of two VIX futures that straddle the target maturity and each day rolling a small fraction from the nearer to the farther contract. The roll-yield effect is mostly negative (contango), with terminal values of all indexes less than $100. Because the slope of the term structure is generally steeper for nearer maturities, the roll-yield effect is strongest for the 30-day constant maturity index (corresponding to VXX) and much weaker for the 150-day constant maturity index (corresponding to VXZ). There are times, however, when the term structure exhibits backwardation (as at the start of the financial crisis), and the roll-yield effect is positive.

In summary, evidence indicates that successful volatility diversification requires unrealistically accurate prediction of returns on VIX futures, and that trading VIX futures and their proxies is therefore speculation rather than diversification.

Cautions regarding findings include:

- Calculations of returns on VIX futures constant maturity indexes are gross, not net. Including the impact of trading frictions (broker fees and bid-ask spreads) necessitated by daily rolling would lower their returns. However, VXX and VXZ account for these frictions (as well as management fees) in their prices.

- Bid-ask spreads for all volatility vehicles are likely elevated during crises.

See “Simple Tests of VXX as Diversifier” and “Short-term VIX Futures Performance” for related analyses.