What works for value stock investors? In his April 2012 paper entitled “Value Investing: Investing for Grown Ups?”, Aswath Damodaran explores success factors for three distinct types of value investing: (1) mechanical screening for stocks with value characteristics such as low earnings multiple, high book-to-market ratio and high return on investment; (2) taking contrarian positions in fallen, unpopular stocks; and, (3) buying large positions in poorly managed, low-valued companies and actively driving turnarounds. Using quantitative examples for U.S. stocks for all three types of value investing, he concludes that:

- Portfolio managers and individual investors who apply mechanical screening to find value generally underperform hypothetical tests because they:

- Do not have long enough investing horizons for the screens to work (five years or greater).

- Incur taxes and trading frictions ignored in hypothetical tests.

- Undercut screening effectiveness via multiple criteria that work against each other.

- Tend to concentrate portfolios in one sector with a structural bias toward “value” characteristics (but not real value).

- Are imitating screens that so many other investors are using (because of known past success) that competition for the associated premium has depressed or eliminated it.

- Success from buying fallen, unpopular stocks requires:

- Again, an investment horizon of at least several years to wait for recovery and suppress cumulative trading frictions.

- Diversification to allow for the fact that some distressed firms will disappear and some sectors are structurally weak (for example, buy the worst performing stock in each sector rather than the worst performing stocks in the entire market).

- Resist the temptation to bail out in the face of bad news and volatile performance.

- Success as an activist value investor (material stakeholder) requires:

- Having the capital to buy a significant stake and thereby induce changes in management behavior.

- A thorough understanding of target firms and considerable time and effort to influence management, effectively limiting diversification.

- Adeptness at forming coalitions with like-minded investors and fortitude to overcome resistance (even abuse) from incumbent managers.

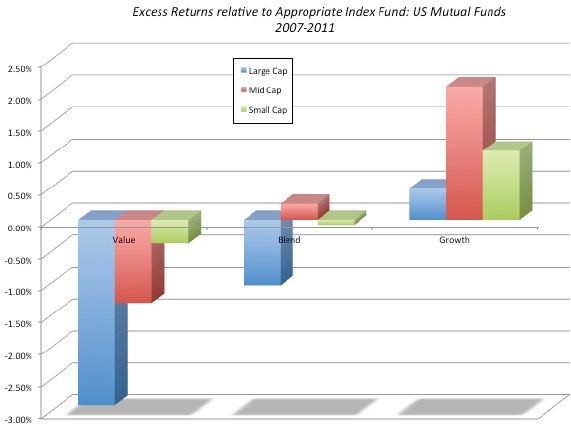

- Active value investors, as a group, seem not to benefit from their efforts to find value. For example, active equity mutual funds focused on growth stocks on average beat their passive index counterparts, while active value funds notably tend to underperform their benchmarks (see the chart below).

The following chart, taken from the paper, summarizes average excess returns for all active U.S. equity growth, blend and value mutual funds, segmented by target market capitalization of holdings, relative to corresponding simple size-style index funds during 2007 through 2011. The only active style that consistently beats its index counterparts is growth. Active value funds consistently underperform their size-style benchmarks, particularly for large capitalization stocks. Short-term performance pressure, at odds with value investing, may account for underperformance.

In summary, evidence indicates that stocks that are out of favor with the market due to firm-level or sector troubles can be good investments, but systematically exploiting their value requires resolute patience and a balance between portfolio diversification and cumulative trading costs.

Cautions regarding findings include:

- The success factors offered are general in nature and difficult to test.

- The example of active value mutual fund underperformance of benchmarks is for a relatively short sample period (the last five years).