Does momentum investing work when implemented via mutual fund alpha? In his February 2012 paper entitled “Short Term Alpha as a Predictor of Future Mutual Fund Performance” (the National Association of Active Investment Managers’ 2012 Wagner Award runner-up), Michael Hartmann examines a momentum-based approach for selecting outperforming equity mutual funds by investment style. He considers nine equity investment styles: Large Capitalization Growth, Large Capitalization Blend, Large Capitalization Value, Mid Capitalization Growth, Mid Capitalization Blend, Mid Capitalization Value, Small Capitalization Growth, Small Capitalization Blend and Small Capitalization Value. He measures momentum based on fund alpha calculated by linear regression of returns versus those of the S&P 500 Index over the past 20, 40, 60, 80 and 100 calendar days. He then forms non-overlapping portfolios of the three highest-alpha funds (weighted equally) for each style every 45, 70, 95, 120, 135 and 170 calendar days over the entire sample period and compares compound annual return rates for these portfolio series to those for corresponding Russell total return style indexes. Using daily total returns for open-ended mutual funds currently available via the no-transaction mutual fund platform at Charles Schwab & Co. and daily returns for the S&P 500 Index from the end of June 1999 through December 2011, along with sample period compound rates of return for Russell benchmark indexes, he finds that:

- Across 225 possible combinations of equity investment style, alpha calculation interval and portfolio holding interval, the alpha winner portfolios outperform respective benchmark indexes by an average annual compound margin of 3.19%, with 193 of 225 (86%) beating their benchmark.

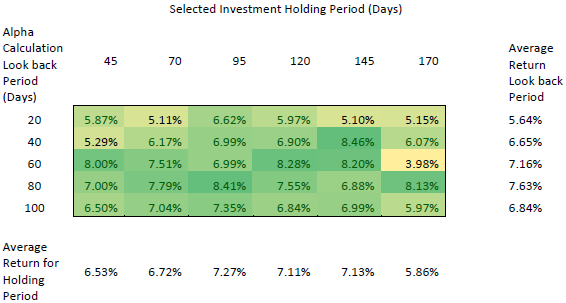

- The combinations with the highest average annual compound rate of return are those with alpha calculation intervals of 60 and 80 days, and holding intervals of 95 to 145 days (see the first table below).

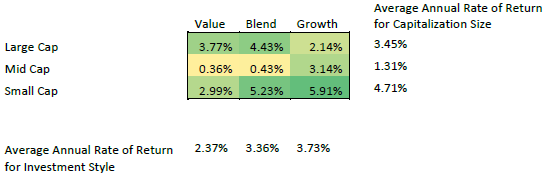

- Outperformance varies considerably across investment styles, with Small Capitalization Blend and Small Capitalization Value exhibiting greatest outperformance (see the second table below).

The following table, taken from the paper, summarizes alpha momentum portfolio compound annual returns over the entire sample period by alpha calculation interval and holding interval. Results suggest an optimal alpha calculation interval of 60-80 days and an optimal holding interval of 95-145 days.

Irregular variations across combinations indicate a material amount of luck in results.

The next table, also from the paper, summarizes alpha momentum portfolio compound annual outperformance relative to corresponding Russell indexes over the entire sample period by equity investment style. Again, irregularities suggest a large role for luck in results.

In summary, evidence indicates that investors may be able to exploit persistence of market outperformance measured over the past few months among U.S. equity mutual funds.

Cautions regarding findings include:

- The high-level summary statistics in the paper do not match the described methodology. Five alpha measurement intervals times six holding intervals time nine investment styles generates 270 combinations. The tables on pages 17-25 of the study indicate that 238 of these 270 combinations (88%) outperform their Russell style index benchmarks. The average annual compound rate of return outperformance of 3.19% across all combinations may not apply to this total set. The author acknowledges the mismatch between summary and raw results and intends to update the paper and ask NAAIM to replace the current version.

- The data collection and processing burden of the momentum calculation method in the study is substantial, and potentially costly if delegated. The simpler and widely used approach of ranking funds based on cumulative lagged returns may be effective.

- Examination of a large number of combinations incorporates data snooping bias such that the performance of the best (worst) combinations likely overstates (understates) expected future performance.

- Extending the methodology to funds for non-equity asset classes would involve regression against some index other than the S&P 500 Index.

- Mutual fund trading restrictions (fees for short holding periods) may interfere with strategy execution for short holding intervals.