How do specialized stock indexes relate to commonly used equity risk factors? In his February 2012 paper entitled “Evaluating Alternative Beta Strategies”, Xiaowei Kang examines risk exposures (betas), construction methodologies and historical performances of alternative stock indexes such as those based on value, low-volatility and diversification strategies. He considers five risk factors: (1) market, representing excess return of the market capitalization-weighted U.S. stock market; (2) size, representing return from a portfolio that is long small-cap stocks and short large-cap stocks; (3) value, representing return from a portfolio that is long high book-to-market stocks and short low book-to-market stocks; (4) momentum, representing return from a portfolio that is long past winning stocks and short past losing stocks; and, (5) volatility, representing return from a portfolio that is long high-volatility stocks and short low-volatility stocks. Using monthly returns for several specialized indexes and the specified risk factors as available through 2011, he finds that:

- An index weighted by market capitalization represents the portfolio that all investors hold collectively, a benchmark for zero-sum measurement of outperformance and underperformance. This weighting strategy minimizes implementation costs via self-rebalancing and optimal investment capacity.

- Among indexes based on alternative weighting strategies:

- Outperformance of value indexes derives from positive exposures primarily to the value factor and secondarily to the size factor.

- Low-volatility indexes (both minimum variance and non-optimized strategies) have market betas significantly below one and strong negative exposures to the volatility factor.

- Diversification indexes (equal weight, diversity weight and risk parity) have market betas fairly close to one, with positive exposures to the size factor (especially equal weight) and negative exposures to the momentum factor due to rebalancing away from past returns.

- Index construction methodology (such as screening stocks in/out based on firm characteristics, constraints on position size and rebalancing rules) have significant implications for both risk factor exposures and costs of implementation.

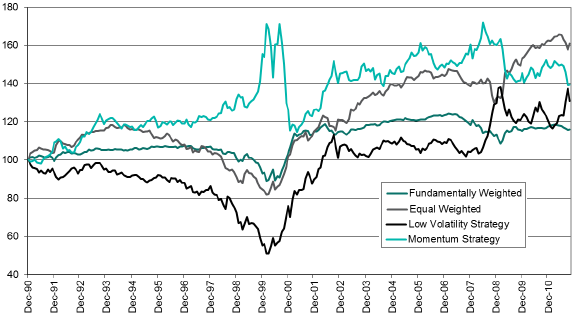

- Factor returns are volatile over time, such that factor-tilted indexes sometimes substantially underperform the capitalization-weighted market index (see the chart below).

- Because returns for common equity risk factors are not highly correlated, a composite index constructed by equally weighting a fundamentally weighted index, an equal-weighted index, a low-volatility index and a momentum index (see the indexes listed below) outperforms the S&P 500 Index during December 1990 through October 2011, with higher gross total annualized return (10.7% versus 8.8%) and lower annual return volatility (14.2% versus 15.1%), while bearing lower total risk factor exposure than its components.

The following chart, taken from the paper, compares historical gross cumulative performance of the following four representative alternative indexes relative to that of the market capitalization-weighted S&P 500 Index:

- Fundamentally Weighted – MSCI USA Value Weighted Index

- Equal Weighted – S&P 500 Equal Weight Index

- Low Volatility Strategy- S&P 500 Low Volatility Index

- Momentum Strategy – AQR US Large Cap Momentum Index

Although all alternative indexes outperform the S&P 500 Index at the end of the sample period, all exhibit subperiods of significant underperformance.

In summary, evidence indicates that investors may reasonably view alternative value, low-volatility and diversification indexes as ideal portfolios tilted toward one or more common equity risk factors.

Cautions regarding findings include:

- Indexes are not tradable. Constructing and maintaining tradable funds involves trading frictions and management fees, which (as indicated in the paper) may differ materially across strategies. Findings for tradable assets may therefore differ.

- Different sample periods for different indexes limit comparisons across strategy types.

- Risk factors, and therefore findings, do not apply to non-equity asset classes.

See the similar “Translating Risk Strategies into Common Factors”.