Do returns for country stock markets vary systematically with the return volatilities of those markets? In their December 2012 paper entitled “Are Investors Compensated for Bearing Market Volatility in a Country?”, Samuel Liang and John Wei investigate the relationships between monthly returns and both total and idiosyncratic volatilities for country stock markets. They measure total market volatility as the standard deviation of country market daily returns over the past month. They measure idiosyncratic market volatility in two ways: (1) standard deviation of three-factor (global market, size, book-to-market ratio) model monthly country stock market return residuals over the past three years; and, (2) standard deviation of one-factor (global market) model country stock market return residuals over the past month. They then relate monthly country market raw return, global one-factor alpha and global three-factor alpha to prior-month country market volatility. Using monthly returns and characteristics for 21 developed country stock markets (indexes) and the individual stocks within those markets, and contemporaneous global equity market risk factors, during 1975 through 2010, they find that:

- For all three measures of country market volatility, high volatility indicates high future monthly return:

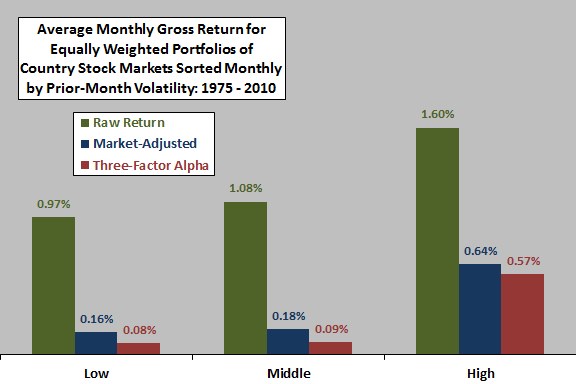

- A hedge portfolio that is each month long (short) the equally weighted third of country stock markets with the highest (lowest) total volatilities generates a gross monthly return of 0.63% and a gross monthly three-factor alpha of 0.51% (see the chart below).

- The second measure of idiosyncratic country market volatility above has the highest correlation with future monthly returns (0.59, compared to 0.40 for total market volatility). A hedge portfolio that is each month long (short) the equally weighted third of country stock markets with the highest (lowest) second measure of idiosyncratic volatilities generates a gross monthly return of 0.69% and a gross monthly three-factor alpha of 0.64%.

- Country stock markets with relatively high (low) sensitivities to change in global equity market volatility tend to generate relatively low (high) returns.

- Total or idiosyncratic country market volatility measured with daily returns dominates global market, value, size and volatility risk factors in explaining country market returns. In other words, country market volatility is the most importing risk factor in explaining that market’s future returns.

The following chart, constructed from data in the paper, summarizes monthly gross returns, market-adjusted returns and three-factor alphas in U.S. dollars for country stock markets sorted each month into three equally weighted portfolios based on prior-month country market total daily return volatilities (Low, Middle, High). Results indicate reward for risk, with the relationship concentrated in high-volatility markets. Results based on country market idiosyncratic volatilities rather than total market volatilities are similar.

In summary, evidence indicates that country market return volatility relates positively to future country market return, and that this volatility measured with past daily returns is the most important factor in predicting future country market return.

Cautions regarding findings include:

- The study essentially uses country market stock indexes, not tradable funds. Incorporating estimated costs for creating and maintaining funds to track these indexes would lower their returns. These costs may vary across countries in such a way to affect findings (for example, costs could be higher for high-volatility markets).

- Returns for volatility-sorted portfolios of country markets are are gross, not net. Including estimated costs for reforming portfolios each month would lower reported returns. Moreover, hedge portfolio returns do not account for the costs (or feasibility) of shorting country stock markets.