Do Morningstar’s analyst ratings predict which mutual funds will do best? In their January 2014 paper entitled “Going for Gold: An Analysis of Morningstar Analyst Ratings”, Will Armstrong, Egemen Genc and Marno Verbeek examine the performance of mutual funds after Morningstar assigns analyst ratings to them. Morningstar initiated these substantially qualitative ratings (Gold, Silver, Bronze, Neutral and Negative) in September 2011, as a supplement to star ratings, to convey expected risk-adjusted performance of funds with respect to peers over a full market cycle of at least five years. Ratings take into account past performance, fees and trading costs, quality of investment team, parent organization and investment process. The study considers both raw returns and four-factor (market, size, book-to-market, momentum) alphas during intervals of one, three and six months after each rating initiation. It also takes into account differences in time frame, fund investment style and fund star rating. Using analyst ratings initiated during September 2011 through December 2012, associated fund characteristics and associated fund returns through June 2013, they find that:

- Over the six months after assignment of ratings, funds rated Gold (Silver) experience an average investment flow 4.2% (3.4%) higher than funds rated Not Recommended. This influence of analyst ratings concentrates in funds with star ratings of four or five.

- There is little evidence that analyst ratings identify outperforming funds at horizons up to six months.

- Using either average raw returns or average alphas, Gold, Silver and Bronze funds do not significantly outperform Not Recommended funds at horizons of one, three or six months.

- At some horizons, Not Recommended funds significantly outperform Gold and Bronze funds. For example, at a three-month horizon, Not Recommended funds have an average raw return (alpha) 1.52% (0.08%) higher than that for Gold funds.

- After adjusting for fund characteristics such as net assets, expense ratio and turnover, there is no evidence that Gold and Silver funds have higher average alphas than Not Recommended funds, or that Gold funds outperform Silver or Bronze funds.

- Equally weighted and monthly rebalanced portfolios of recommended funds do not outperform a portfolio of Not Recommended funds.

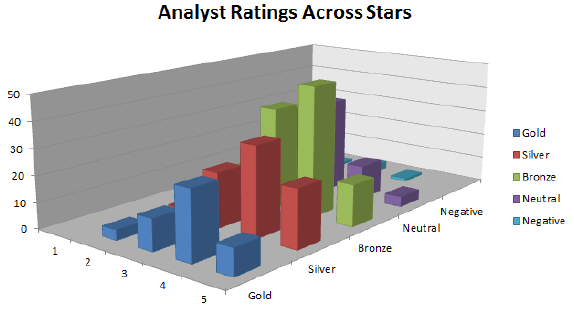

The following chart, taken from the paper, summarizes the relationship between Morningstar’s substantially qualitative analyst ratings and strictly quantitative star ratings. It shows that the two rating systems differ. Funds with four stars have a disproportionately large share of Gold, Silver and Bronze ratings. Funds with three stars have a disproportionately large share of Neutral and Not Recommended (Negative) ratings.

In summary, evidence to date offers little support to a belief that Morningstar analyst ratings predict future relative performance of mutual funds on either raw or risk-adjusted basis.

Cautions regarding findings include:

- As noted in the paper, fund performance measurement intervals are much shorter than a full market cycle as contemplated by Morningstar in the design of analyst ratings. Data are not available for market cycle analysis.

- The study does not discover any way for investors to identify funds likely to outperform.