Is there an easy way to avoid unfavorable positions within a currency carry trade strategy (long currencies with high interest rates and short those with low)? In their July 2015 paper entitled “Conditioning Carry Trades: Less Risk, More Return!”, Arjen Mulder and Ben Tims examine a carry trade strategy that avoids currencies for which exchange rate return is likely to offset interest rate return (the carry trade is unlikely to work). Based on prior research, they hypothesize that carry-trade-won’t-work conditions are: (1) very high absolute interest rate differences; plus, (2) high exchange rate volatility. They specify an interest rate difference as extreme if it is among the 10% highest monthly absolute differences across all currencies relative to the U.S. dollar over the last 60 months. They specify exchange rate volatility as extreme if the five-year exponential moving average of squared differences between conventional carry trade returns and the average carry trade return over the last 60 months is among the top 25% of values. Using monthly spot exchange rates versus the U.S. dollar and interest rates for 25 currencies as available during January 1975 through May 2015 (with the first ten years used to define interest rate difference and exchange rate volatility conditions as of January 1985), they find that:

- On average, the conventional carry trade works.

- For two long (short) positions, reformed monthly, this strategy generates an average gross annual return of 4.74%, with annual standard deviation 10.1% and gross annual Sharpe ratio 0.47.

- Currencies selected most often for the long (short) side of this strategy are Australia, Greece, Iceland, Italy, New Zealand and the UK (Japan, Singapore and Switzerland).

- Modifying the carry trade strategy by avoiding currencies with extremely high interest rate differences generates an average gross annual return of 4.40%, with annual standard deviation 9.7% and gross annual Sharpe ratio 0.45.

- Modifying the carry trade strategy by going to cash when exchange rate volatility is extremely high generates an average gross annual return of 4.69%, with annual standard deviation 7.3% and gross annual Sharpe ratio 0.64.

- Modifying the carry trade strategy by avoiding currencies with extremely high interest rate differences only when exchange rate volatility is extremely high generates an average gross annual return of 5.76%, with annual standard deviation 10.0% and gross annual Sharpe ratio 0.58 (see the chart below).

- Findings are generally robust to varying the threshold for extreme interest rate difference, the definition of interest rate difference, the threshold for extreme volatility and the definition of exchange rate volatility. Results are also generally robust to excluding intervals around the 2008-2009 financial crisis and limiting choices to the G-10 currencies.

- However, the number of positions is important. The two-condition strategy works best for concentrated portfolios: two long-two short and one long-one short.

- The S&P 500 implied volatility index (VIX) works reasonably well as a proxy for exchange rate volatility.

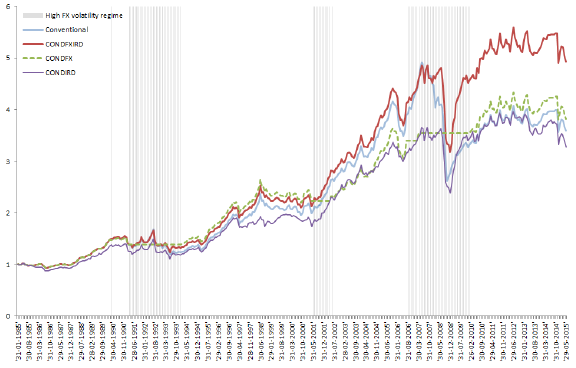

The following chart, taken from the paper, compares accumulated wealth of $1 initial investments in each of four strategies:

- Conventional – continuously holds two long (short) positions in the two currencies with the highest (lowest) interest rates.

- CONDFXIRD – based on a five-year rolling window, ignores currencies in the top 10% of interest rate differentials when exchange rate volatility is in the top 25%.

- CONDFX – based on a five-year rolling window, is in cash when exchange rate volatility is in the top 25%.

- CONDIRD – based on a five-year rolling window, ignores currencies in the top 10% of interest rate differences.

Shaded areas indicate when exchange rate volatility is in the top 25%. Results show that strategy 2 has the highest terminal value. However, its outperformance relative to the conventional carry trade concentrates in 2009, and it suffers a very large drawdown in 2008.

In summary, evidence indicates that avoiding currencies with extremely high interest rate differences when markets are volatile may improve performance of a concentrated currency carry trade strategy.

Cautions regarding findings include:

- Performance statistics are gross, not net. Accounting for monthly portfolio reformation frictions would reduce returns and Sharpe ratios.

- The winning two-condition strategy appears to suffer large drawdowns, which the authors do not quantify.

- Robustness tests do not check whether the five-year look-back window for determining whether interest rate differences and market volatility are extreme is lucky.