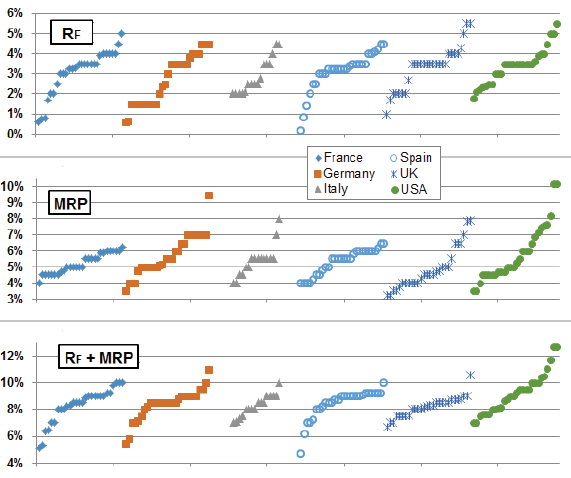

What do company valuation experts think about the level of the risk-free rate and the equity risk premium? In their October 2015 paper entitled “Huge Dispersion of the Risk-Free Rate and Market Risk Premium Used by Analysts in 2015”, Pablo Fernandez, Alberto Pizarro and Isabel Acín summarize assumptions about the risk-free rate (RF) and the market/equity risk premium (MRP or ERP) used by expert analysts to value companies in six countries (France, Germany, Italy, Spain, UK and U.S.). Using 156 company valuation reports from 2015, they find that:

- Average values of RF range from 2.7% to 3.4% across countries, with standard deviations 0.8% to 1.2%. The average for the U.S. is 3.4%. Results suggest that analysts view currently very low yields on government securities as distorted/manipulated.

- Average values of MRP/ERP range from 4.8% to 5.8% across countries, with standard deviations 0.6% to 1.8%. The average for the U.S. is 5.8%.

- Analyst practice exhibits substantial disagreement with Damodaran’s approach to ERP estimation.

The following charts, taken from the paper, shows the distributions of RF, MRP/ERP and the sum of these two variables found in 156 recent analyst company valuation reports.

In summary, recent analyst valuation reports exhibit wide dispersion in assumptions about the risk-free rate and the equity risk premium, and suggest widespread belief that current yields on government securities are invalid for estimating the risk-free rate.

Cautions regarding findings include:

- Subsamples by country are small.

- The study does not explore how analysts actually develop the RF and ERP estimates they use.