Should investors trust retirement planning tools that are publicly available on financial websites? In their February 2016 paper entitled “The Efficacy of Publicly-Available Retirement Planning Tools”, Taft Dorman, Barry Mulholland, Qianwen Bi and Harold Evensky:

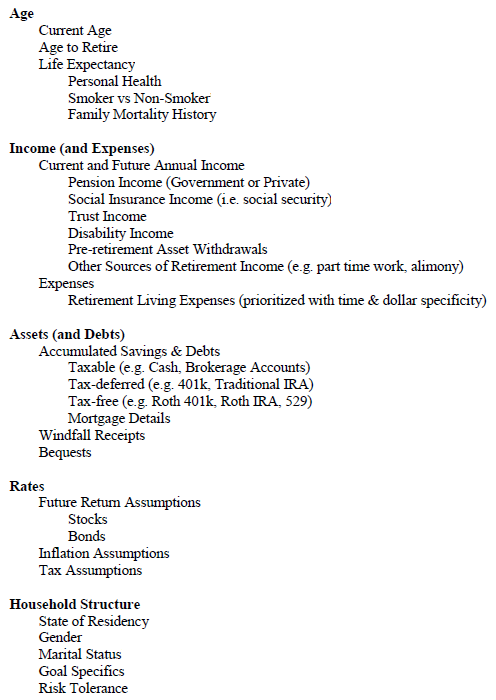

- Identify via theoretical analysis and a survey of financial professionals the demographic, financial and economic variables important as inputs to retirement planning.

- Assess effectiveness in using these inputs of 36 retirement planning tools available at no/modest cost without the intervention of a financial professional.

The second step is based on the following retirement scenario:

- Couple (male age 59 and female age 57), each with annual income $50,000.

- Total current investment assets $700,000.

- Expected retirement ages 65 and 63, respectively.

- Expected annual real retirement expenses after income taxes $70,000.

- Social Security income to begin at age 66.

- Life expectancies 90 and 92, respectively.

They establish a benchmark by using these inputs in MoneyGuidePro (used by the plurality of professionals responding to the survey) with estimates for expected investment return, inflation rate and tax rate, generating an unacceptably low 53% probability of successful retirement. If a retirement planning tool using these same estimates (to the extent it can) indicates that the couple can retire as expected qualitatively with a simple statement or quantitatively with 70%+ confidence, they classify the tool as failed. Using survey responses from 297 financial professionals, MoneyGuidePro and the 36 retirement planning tools, they find that:

- On average, the 36 tools tested use only 57% of the 10 inputs from theory and 36% of the 24 inputs from both theory and professional opinion.

- Only four tools use all 10 theoretical inputs.

- Only nine tools use at least 12 of the 24 total inputs (none use all 24).

- 25 of 36 tools fail to warn the couple that their retirement plan is too risky.

- Among the 11 tools that pass, there is a large variation in estimated probability of successful retirement.

The following list, taken from the paper, is the minimum set of inputs that the authors believe important for retirement planning.

In summary, evidence from simple tests indicates lack of consistency in inputs used and default settings among publicly available retirement planning tools, such that most generate misleading retirement expectations.

Cautions regarding findings include:

- The corresponding author reports that scenario testing assumes an annual investment return of about 6.5% with 3% inflation and a 25% federal income tax rate for the couple.

- Even with planning tools that robustly use many inputs, modeling expected investment return and inflation rate is problematic. Available historical samples are small in terms of number of independent planning horizons. In other words, estimates of future rates are not statistically reliable, and simulations based on such inputs therefore cannot be reliable.

- Longevity (length of retirement) estimation is also generally difficult.