Does cyclic information flow from the Federal Open Market Committee (FOMC) drive equity market returns? In the June 2016 update of their paper entitled “Stock Returns Over the FOMC Cycle”, flagged by a subscriber, Anna Cieslak, Adair Morse and Annette Vissing-Jorgensen investigate interaction of the FOMC six-week meeting cycle with excess U.S. and worldwide stock market (relative to the U.S. Treasury bill). Within the FOMC meeting cycle, they look at:

- Meetings of the Federal Reserve Board of Governors and public releases of Federal Reserve book updates, statements and meeting minutes.

- Other potentially influential economic news cycles, including reserve maintenance period, macroeconomic news releases and corporate earnings announcements.

- Evidence on leaks from the Federal Reserve via media and private newsletters (with focus on Wall Street Journal articles on monetary policy).

- Public statements of Federal Reserve officials and conversations with current and former officials.

Using these data, FOMC meeting dates and daily U.S. and global (overall, developed and emerging) stock market returns, returns for individual U.S. stocks, U.S. Treasury bill (T-bill) yield and 10-year U.S. Treasury note yield during 1994 through 2015, they find that:

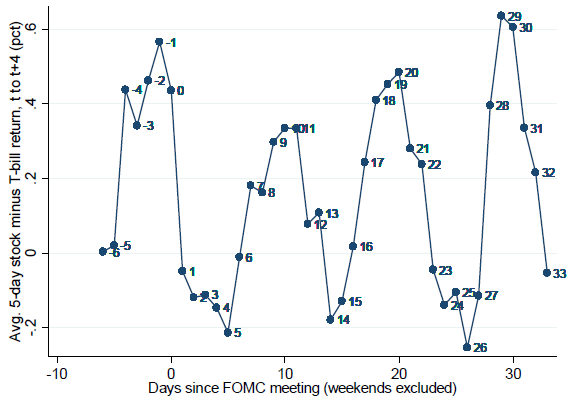

- Over the sample period, the U.S. equity risk premium (stock market return minus T-bill yield) accrues entirely during weeks 0, 2, 4 and 6 of the FOMC meeting cycle (see the chart below).

- This biweekly pattern is robust for 1994-2006 and 2007-2015 subperiods.

- The pattern is amplified for high-beta stocks.

- A strategy that holds the U.S. stock market only during FOMC meeting cycle even weeks generates an average gross annual excess return of 11.8% with standard deviation 13.3%, translating to gross annual Sharpe ratio 0.88. Respective statistics for buying and holding the market are 8.3%, 19.1% and 0.43.

- Additionally shorting the U.S. stock market during FOMC meeting cycle odd weeks boosts average gross annual excess return to 14.8% but also increases annual volatility to 21.1%, thereby reducing Sharpe ratio to 0.70.

- The pattern also holds for the MSCI World equity market index and separately for MSCI developed and emerging market indexes.

- The pattern does not hold for 10-year U.S. Treasury note returns.

- Federal Reserve reaction to poor stock market returns (a surprising intent to ease monetary conditions) is the principal driver of the pattern, most likely communicated informally by Federal Reserve officials to the media and to individuals in the financial industry.

The following chart, taken from the paper, tracks average U.S. stock market excess return over the next five days in percent by weekday (omitting weekends and setting holiday returns to zero) across the FOMC meeting cycle during the sample period (176 meetings). Day 0 is the meeting day, and 10 days corresponds to two calendar weeks. Results indicate a pronounced biweekly cycle in next-week excess return. Results are similar for global equity markets.

In summary, evidence indicates that there is a biweekly cycle in stock market returns driven by Federal Reserve reaction to poor lagged returns and communicated informally to the media and financial industry insiders.

Cautions regarding findings include:

- Return calculations are gross, not net. Accounting for FOMC meeting cycle even-week entries and odd-week exits from stocks (26 round trips per year) would reduce these returns. Shorting costs would debit profitability of shorting during odd weeks.

- The argument posits that surprising Federal Reserve intent to ease monetary conditions in response to recent stock market weakness stems from the October 1987 crash experience. Federal Reserve behavior could change.

- Public discussion of the findings of this paper may inhibit the informal communication from Federal Reserve officials to the media and financial industry insiders, thereby disrupting the pattern.

See also “FOMC Drives Global Equity Markets?”.