Does stock momentum purified of market, size and book-to-market factor risks (idiosyncratic or residual or pure momentum) distinctly outperform conventional momentum? In their April 2017 paper entitled “The Idiosyncratic Momentum Anomaly”, David Blitz, Matthias Hanauer and Milan Vidojevic revisit idiosyncratic past stock return as a return predictor. They specify conventional momentum as total return from 12 months ago to one month ago. To calculate idiosyncratic momentum, for each stock each month they: (1) estimate idiosyncratic return as the part of total return not explained by Fama-French 3-factor (market, size and book-to-market) model betas determined from the prior 36 months; and, (2) calculate idiosyncratic momentum as the volatility-adjusted sum of monthly idiosyncratic returns from 12 months ago to one month ago. They then calculate idiosyncratic momentum factor returns from a monthly reformed hedge (Winners-Minus-Losers, or WML) portfolio that is long big and small stocks with the highest idiosyncratic momentum and short big and small stocks with the lowest. Using monthly stocks/firms data for a broad sample of U.S. common stocks since December 1925, for stocks/firms and currencies in Europe, Asia-Pacific and Japan since January 1989 and for stocks/firms and currencies in emerging markets since January 1992, all through December 2015, they find that:

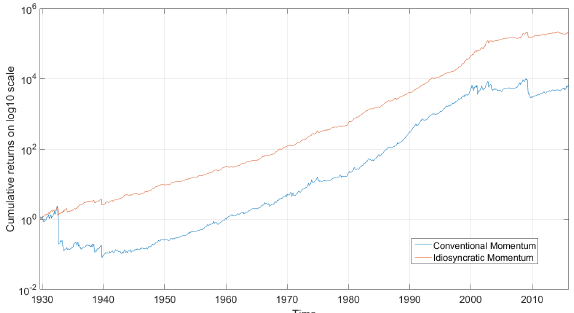

- Idiosyncratic momentum portfolios reliably generate gross average returns comparable to those of conventional momentum, with half the volatility. Specifically, for the long U.S. sample (see the chart below):

- Gross average returns, Sharpe ratios and 3-factor alphas increase systematically across portfolios reformed monthly into tenths (deciles) from lowest to highest idiosyncratic momentum.

- The idiosyncratic momentum factor has average gross monthly return 1.39%, compared to 1.54% for the conventional momentum factor.

- Because of its lower volatility, gross monthly Sharpe ratio of the idiosyncratic momentum factor is 0.48, compared to 0.25 for the conventional momentum factor.

- The idiosyncratic momentum factor has smaller but more reliable 3-factor and 5-factor (adding profitability and investment factors) alphas than the conventional momentum factor.

- No set of established stock pricing factors, including conventional momentum, explain idiosyncratic momentum factor returns.

- Idiosyncratic and conventional momentum behave more like complements than substitutes.

- Gross profitability of the idiosyncratic momentum factor is much less affected by market conditions than that of the conventional momentum factor, and is positive following both bull and bear markets.

- Controlling for other known predictors of the cross section of stock returns, high idiosyncratic (conventional) momentum forecasts high (high) short-term to intermediate-term stock returns and high (insignificant to low) long-term returns. In other words, idiosyncratic momentum appears to avoid high-momentum stocks prone to reversal.

- As for the U.S. sample, the idiosyncratic momentum factor outperforms the conventional momentum factor based on Sharpe ratio (by suppressing volatility) in all markets tested.

The following chart, taken from the paper, compares cumulative gross performances of equally weighted and monthly reformed idiosyncratic and conventional momentum factor portfolios for the long U.S. sample. Use of idiosyncratic returns avoids nearly all of the conventional momentum crash of the early 1930s, but absorbs some of the crash 2009.

In summary, evidence indicates that idiosyncratic (pure or residual) momentum generally outperforms conventional momentum due to lower volatility derived from avoiding high-momentum stocks prone to reversal.

Cautions regarding findings include:

- Performance results are gross, not net. Accounting for monthly portfolio reformation and shorting costs would reduce profitability. Shorting may not always be feasible as specified due to lack of shares to borrow. The paper does not address turnover of idiosyncratic momentum factor portfolios as an indicator of monthly reformation frictions. The corresponding author reports that this turnover is modestly higher than that of the conventional momentum factor portfolio (which tends to be high compared to turnovers of other factor portfolios).

- Constructing and maintaining an idiosyncratic momentum portfolio is beyond the reach of most investors, who would bear fees for delegating the process to an investment/fund manager.

- From the chart above: idiosyncratic momentum generally underperforms conventional momentum during 1940-2000; and, idiosyncratic momentum weakens after the early 2000s.

See “Stripping Risks from a Stock Momentum Strategy” for a summary of antecedent research. See also: