A “pump-and-dump” scheme promoter: (1) builds a position in a stock (often a thinly traded penny stock); (2) gooses its price by spreading misleading information; and, (3) liquidates the position once the stock reaches. Who responds to such schemes and what are their returns? In the December 2018 revision of their paper entitled “Who Falls Prey to the Wolf of Wall Street? Investor Participation in Market Manipulation”, Christian Leuz, Steffen Meyer, Maximilian Muhn, Eugene Soltes and Andreas Hackethal investigate pump-and-dump scheme participation rate, purchase size/returns and participant characteristics. Specifically, they explore the intersection of 421 such schemes (both from the responsible German regulatory agency and hand-selected) and trading records/demographics for 113,000 randomly selected individual investors from a major German bank. Using the specified data spanning 2002 through 2015, they find that:

- German stocks dominate the pump-and-dump scheme sample (73%). Touted stocks are most often financial services firms (27%), but mining, software and oil & gas companies are also common. E-mail (30%) and phone (29%) are the most common means of touting.

- The investor sample is predominantly male (83%), with average age 52.

- Regarding pump-and-dump scheme participants:

- 5.8% of sampled investors participate, often via multiple purchases per scheme during the 60 days after touting starts.

- Investors who hold more stocks, hold relatively more penny stocks, hold relatively fewer blue chip stocks and have smaller positions are more likely to participate. Over a third of participants day-trade penny stocks or otherwise trade frequently with short investment horizons.

- Those who suffer relatively poor returns from a past scheme are less inclined to invest in another. Those with relatively good returns tend to participate also in the next scheme and hold longer (hurting performance). About 11% buy into four or more schemes.

- Regarding pump-and-dump scheme participant trades:

- Average total position size for a scheme is €6,972 (11.4% of participant portfolio value).

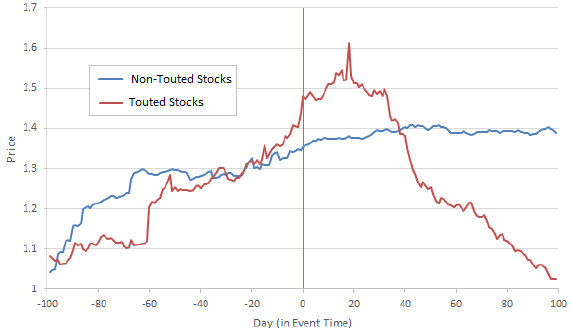

- Average (median) return during the 120 trading days after first tout is -53% (-70%). However, average return to scheme participants is -28%, indicating that they tend to liquidate earlier. (See the chart below.)

- Investors who participate in more than one scheme perform slightly better than one-time participants, with average return -24% across all the schemes they pick.

- Average aggregate loss per scheme for German investors is at least €1.2 million.

The following chart, taken from the paper, compares average standardized price paths for pump-and-dump scheme (touted) stocks and non-touted stocks matched stocks (based on raw prices at five dates before the first tout) from 100 trading days before through 100 trading days after the first tout. Results show the effects of promoter position build-up (not much), touting (price spike) and promoter position liquidation (rapid price drop).

In summary, evidence indicates that about 6% of retail German investors participate in pump-and-dump schemes and lose badly on associated trades.

Cautions regarding findings include:

- Results for other countries may differ.

- It may be much more difficult to recognize stock pump-and-dump activity in real time than retrospectively.