Explore CXO's Trading Strategies

Use our monthly signals to enhance your portfolio.

A Quick Rundown

Our Momentum Strategy tracks the performance of three versions of the Simple Asset Class ETF Momentum Strategy, which seeks strategic diversification across asset classes via ETFs plus a monthly tactical edge from intermediate-term momentum per the stream of research itemized in What Works Best?

Our Value Strategy tracks the performance of the Simple Asset Class ETF Value Strategy, a partial value complement to the Momentum Strategy that seeks diversification across a smaller set of asset class ETFs plus a monthly tactical edge from potential undervaluation of three risk premiums.

Current Value Allocations

Read more about our Value StrategyCurrent Momentum Allocations

Read more about our Momentum StrategyUse Both Strategies for Diversification

Are the "Simple Asset Class ETF Value Strategy" (SACEVS) and the "Simple Asset Class ETF Momentum Strategy" (SACEMS) mutually diversifying. To check, based on feedback from subscribers about combinations of interest, we look at three equal-weighted (50-50) combinations of the two strategies, rebalanced monthly:

- 50-50 Best Value - EW Top 2: SACEVS Best Value paired with SACEMS Equally Weighted (EW) Top 2 (aggressive value and somewhat aggressive momentum).

- 50-50 Best Value - EW Top 3: SACEVS Best Value paired with SACEMS EW Top 3 (aggressive value and diversified momentum).

- 50-50 Weighted - EW Top 3: SACEVS Weighted paired with SACEMS EW Top 3 (diversified value and diversified momentum).

We consider as a benchmark a simple technical strategy (SPY:SMA10) that holds SPDR S&P 500 ETF Trust (SPY) when the S&P 500 Index is above its 10-month simple moving average and 3-month U.S. Treasury bills (Cash, or T-bills) when below. We also test sensitivity of results to deviating from equal SACEVS-SACEMS weights. Using monthly gross returns for SACEVS, SACEMS, SPY and T-bills during July 2006 through July 2024, we find that:

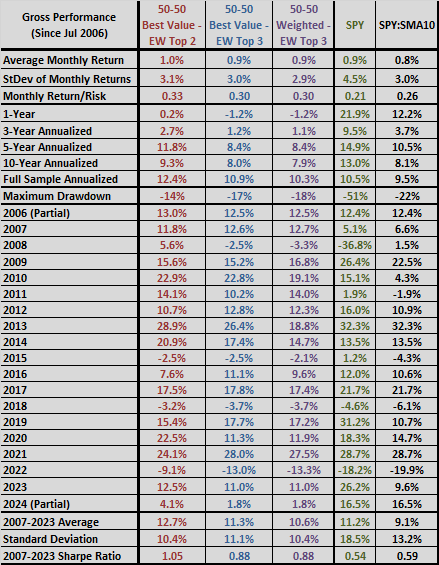

Correlations of monthly returns between components of 50-50 Best Value - EW Top 2, 50-50 Best Value - EW Top 3 and 50-50 Weighted - EW Top 3 are 0.34, 0.47 and 0.54, respectively, indicating that the value and momentum strategies moderately diversify each other.

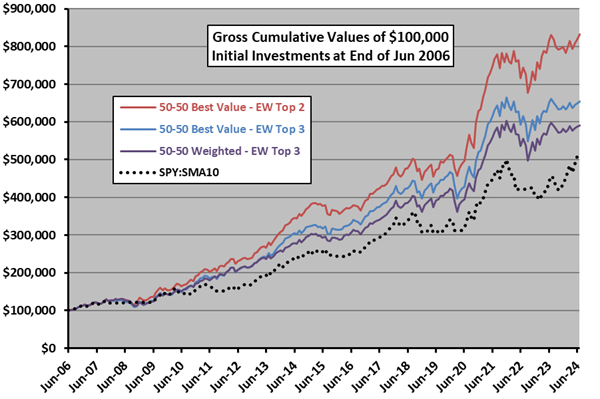

The following chart plots gross cumulative values of $100,000 initial investments in each of the three 50-50 SACEVS-SACEMS combinations specified above and SPY:SMA10 over the full sample period. Notable points are:

- The most aggressive combination wins the horse race. All three combinations beat SPY-SMA10.

- Compound annual growth rates (CAGR) are 12.7%, 11.3%, 10.6% and 9.1% for 50-50 Best Value - EW Top 2, 50-50 Best Value- EW Top 3, 50-50 Weighted - EW Top 3 and SPY:SMA10, respectively.

- Maximum drawdowns (MaxDD) based on monthly data are -14%, -17%, -18% and -22%, respectively.

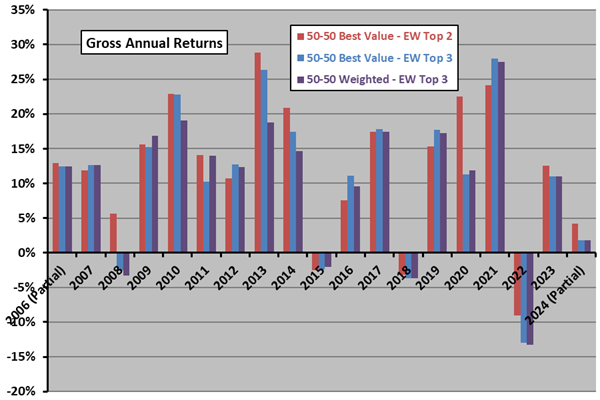

For another perspective, we look at calendar year returns.

The next chart summarizes gross annual returns for 50-50 Best Value - EW Top 2, 50-50 Best Value - EW Top 3, 50-50 Weighted - EW Top 3 and SPY:SMA10. Using average monthly T-bill yield during a year as the risk-free rate for that year, respective gross annual Sharpe ratios for full years 2007 through 2023 are 1.05, 0.88, 0.88 and 0.59.

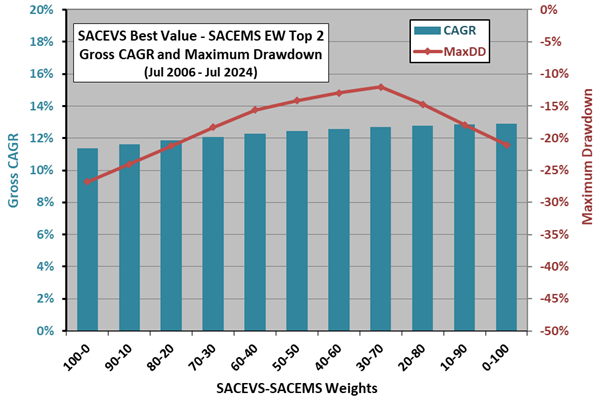

Are 50-50 mixes optimal?

The next chart summarizes CAGR and MaxDD sensitivities to Best Value - EW Top 2 weights, ranging from 100% allocation to SACEVS Best Value (100-0) to 100% allocation to SACEMS EW Top 2 (0-100). Results suggest that a tilt toward SACEMS EW Top 2 is optimal, but the sample period is short for this level of discrimination.

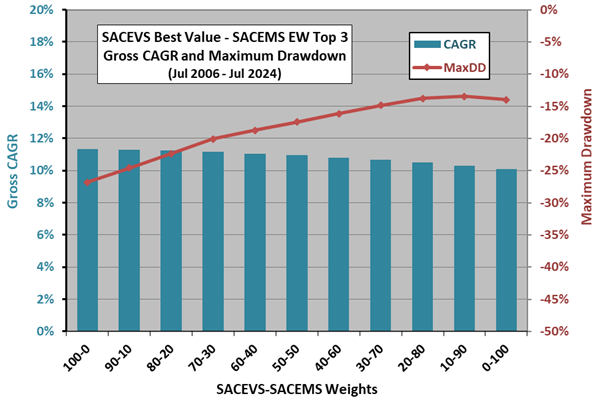

The next chart summarizes CAGR and MaxDD sensitivities to Best Value - EW Top 3 weights, ranging from 100% allocation to SACEVS Best Value (100-0) to 100% allocation to SACEMS EW Top 3 (0-100). Results do not clearly suggest any tilt, depending on investor drawdown tolerance, but again the sample period is short for this level of discrimination.

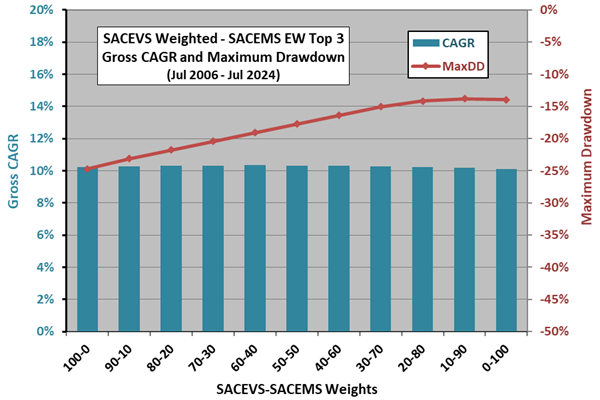

The final chart summarizes CAGR and MaxDD sensitivities to SACEVS Weighted and SACEMS EW Top 3 weights, ranging from 100% allocation to SACEVS Weighted (100-0) to 100% allocation to SACEMS EW Top 3 (0-100). Results suggest that a tilt toward SACEMS EW Top 3 is optimal, but again the sample period is short for this level of discrimination.

For reference, the following table provides detailed gross performance statistics for the three combination strategies with 50-50 allocations, and those for SPY and SPY:SMA10. Monthly return/risk is average monthly return divided by standard deviation of monthly returns.

In summary, evidence from available samples suggests that SACEMS and SACEVS in combination usefully diversify each other.

Cautions regarding findings include:

- Analyses ignore trading frictions associated with base strategies and with rebalancing the 50-50 combination each month. Frictions are likely highest for 50-50 Weighted - EW Top 3 and lowest for 50-50 Best Value - EW Top 2.

- As noted, available sample periods are short for analysis of annual returns and sensitivity testing.

- Testing multiple combinations on the same data introduces data snooping bias, such that the best-performing combination overstates expectations.

- Cautions outlined in "Simple Asset Class ETF Value Strategy" and "Simple Asset Class ETF Momentum Strategy" apply.

See "Combined Value-Momentum Strategy (SACEVS-SACEMS)" for monthly tracking of the above three 50-50 combination strategies.