Combined Value-Momentum Strategy (SACEVS-SACEMS)

The Simple Asset Class ETF Value Strategy (SACEVS) seeks diversification across a small set of asset class exchange-traded funds (ETF) plus a monthly tactical edge from timing term, credit and equity risk premiums. The two versions of SACEVS are: (1) most undervalued premium (Best Value) ; and, (2) weighting all undervalued premiums according to respective degree of undervaluation (Weighted).

The Simple Asset Class ETF Momentum Strategy (SACEMS) seeks diversification across asset classes via ETFs plus a monthly tactical edge from intermediate-term momentum. The three versions of SACEMS, all based on total ETF returns over recent months, are: (1) top one of nine ETFs (Top 1); (2) equally weighted top two (EW Top 2); and, (3) equally weighted top three (EW Top 3).

Based on feedback from subscribers about combinations of interest, we look at three equal-weighted (50-50) diversifying combinations of SACEVS and SACEMS, rebalanced monthly:

- 50-50 Best Value – EW Top 2: SACEVS Best Value paired with SACEMS Equally Weighted (EW) Top 2 (aggressive value and somewhat aggressive momentum).

- 50-50 Best Value – EW Top 3: SACEVS Best Value paired with SACEMS EW Top 3 (aggressive value and diversified momentum).

- 50-50 Weighted – EW Top 3: SACEVS Weighted paired with SACEMS EW Top 3 (diversified value and diversified momentum).

Supporting research includes (items may at times be unavailable for a few days during updates):

- “SACEMS-SACEVS for Value-Momentum Diversification” tests benefits of diversifying across asset class ETFs based on both relative momentum and relative value.

- “SACEVS and SACEMS Strategy Momentum?” examines momentum of SACEVS and SACEMS returns to guide relative weighting of the two in a combined value-momentum strategy.

- “Suppress SACEVS Drawdowns in Combined SACEVS-SACEMS?” tests a shift to 100% SACEMS when the SACEVS Best Value holding is technically weak.

- “SACEVS Best Value + SACEMS EW Top 2?” tests an alternative to the tracked combined value-momentum strategy.

- “Substitute QQQ for SPY in SACEVS and SACEMS?” tests effects of using a different, thematic index for large capitalization stocks. “Horse Race: SSO or QQQ vice SPY in SACEVS and SACEMS?” extends that test to a comparison of thematic and leveraged stocks.

- “Forcing SACEMS to Agree with SACEVS” tests effects on Simple Asset Class ETF Momentum Strategy (SACEMS) performance of forcing SACEMS to agree with SACEVS when the latter assigns zero weight to stocks or government bonds.

- “SACEMS-SACEVS Diversification with Mutual Funds” provides an extended test of the benefits of diversifying across asset classes based on both relative momentum and relative value with sets of mutual funds.

- “SACEMS and SACEVS Changes for Coordination and Liquidity” documents minor April 2017 adjustments that trade purity of logic for practicality.

- “SACEVS-SACEMS Leverage Sensitivity Tests” explores use of margin rebalanced monthly to boost performance. “Conditionally Substitute SSO for SPY in SACEVS and SACEMS?” test a single specific leveraged asset substitution in SACEVS and SACEMS.

Some additional relevant but less directly applicable research is in the last list of items in “What Works Best?“.

Some investors may want to follow one of the 50-50 combined strategies. Others may want to modify the strategy with other than equal weights for SACEVS and SACEMS, as explored in “SACEMS-SACEVS for Value-Momentum Diversification”.

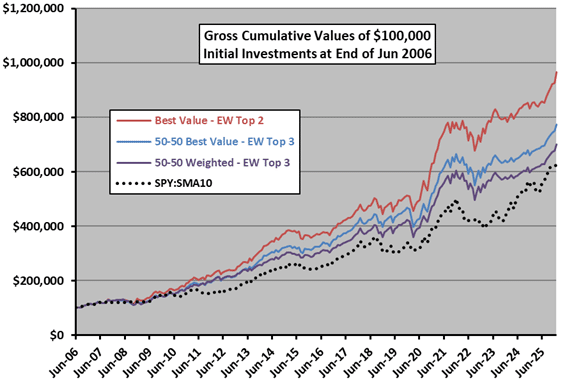

Cumulative Performance

The following chart tracks gross cumulative values of $100,000 initial investments in each of the above three combination strategies since the end of June 2006. It includes as a benchmark a simple technical strategy (SPY:SMA10) that holds SPDR S&P 500 ETF Trust (SPY) when the S&P 500 Index is above its 10-month simple moving average and 3-month U.S. Treasury bills (Cash, or T-bills) when below.

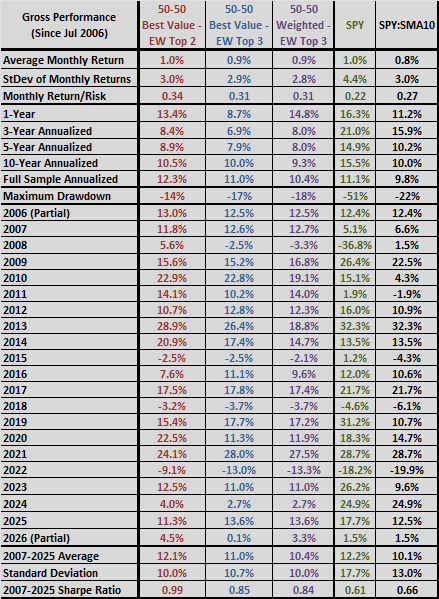

For perspective, we look at an array of performance metrics.

Performance Statistics

The following table summarizes annual/annualized returns for these three strategies, and for SPY and SPY:SMA10. Annualized returns are compound annual growth rates. Maximum drawdown is the deepest peak-to-trough drawdown for these strategies based on monthly measurements over the sample period. For Sharpe ratio, to calculate excess annual return, we use average monthly yield on 3-month Treasury bills during a year as the risk-free rate for that year.

Portfolio performance calculations are based on assumptions as summarized in Value Strategy and Momentum Strategy.

Something to keep in mind is that testing different SACEMS-SACEVS combinations and/or adjusting weights based on sensitivity tests incorporates data snooping bias, such that the best-performing combination overstates expectations.