Does the seasonal shift marked by the Easter holiday, with the U.S. stock market closed on the preceding Good Friday, produce anomalous returns? To investigate, we analyze the historical behavior of the S&P 500 Index before and after the holiday. Using daily closing levels of the S&P 500 index for 1950-2023 (74 events), we find that:

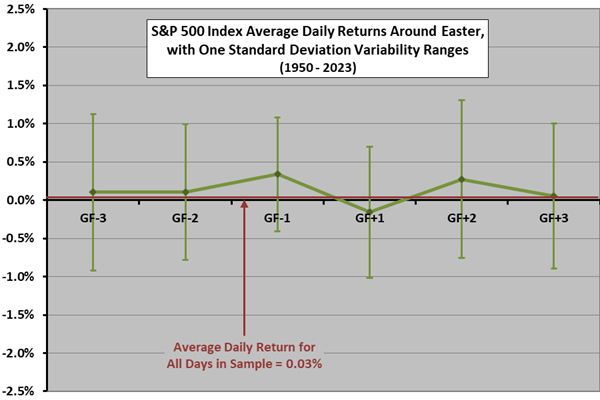

The following chart shows average daily S&P 500 Index returns for the three trading days before (GF-3 to GF-1) and the three trading days after (GF+1 to GF+3) the Good Friday market closure over the full sample period, with one standard deviation variability ranges. Average daily return for all trading days in the sample is 0.03%. Results on average suggest an up-down-up oscillation from the trading day just before through two trading days after Good Friday.

To check the reliability of this pattern, we look at two subsamples.

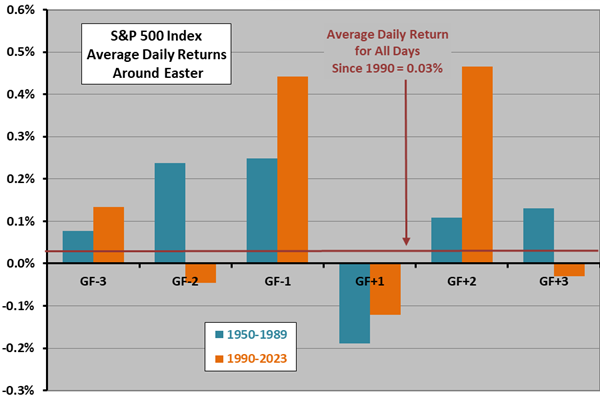

The next chart compares the average daily returns for the three trading days before and three trading days after Good Friday for two subsamples: 1950-1989 (40 events), and 1990-2023 (34 events). This chart has no variability ranges and uses a finer vertical scale than the preceding one. Results support some belief in the pattern noted above.

In summary, best guess is that there may be an anomalous up-down-up oscillation in the U.S. stock market from the trading day just before through two trading days after Good Friday.

Cautions regarding the finding include:

- Any return anomaly is small compared to return variability, so experiences around any given Good Friday vary widely.

- To the extent that the distribution of daily S&P 500 Index returns is wild, interpretation of the average return and standard deviation of returns breaks down.