Do highly shorted stocks tend to underperform? If so, is this underperformance exploitable? In the February 2011 draft of their paper entitled “Short Sale Return Predictability Revisited: Anomaly or Return Mis-measurement?”, Zsuzsa Huszár and Wenlan Qian investigate the sources of negative returns associated with stocks that have high levels of short interest. They use short interest ratio (SIR) to measure level of short interest. They compare portfolios matched for size, book-to-market ratio and six-month momentum to isolate the effects of short interest level. Using monthly short interest levels, shares outstanding, institutional ownership, analyst forecasts, firm fundamentals, returns, trading volumes and (as available) stock lending data for a broad sample of NYSE-AMEX and NASDAQ stocks over the period January 2004 through December 2008 (60 months), they find that:

- Heavily shorted stocks tend to have relatively small market capitalization, high liquidity, low book-to-market ratio and high institutional ownership.

- The power of monthly short interest to predict future returns does not come from new private information (unpredictable changes in short interest), exhaustion of shares available to borrow or future reduction in institutional holdings.

- Adjustment for the relatively high liquidity of heavily shorted stocks accounts for a small portion of their future underperformance.

- Most cogently, the substantially negative abnormal gross monthly returns associated with heavy shorting (average -0.7% to -0.6%) concentrates in stocks with high borrowing fees (high shorting costs), which tend to have relatively high idiosyncratic volatility. There is also some evidence of positive returns for lightly shorted stocks with high borrowing fees.

- After including borrowing fees as income to parties loaning stock, the average abnormal gross monthly return of heavily shorted stocks with high borrowing fees become economically and statistically insignificant (0.33% and 0.37% for equal-weighting and value-weighting, respectively).

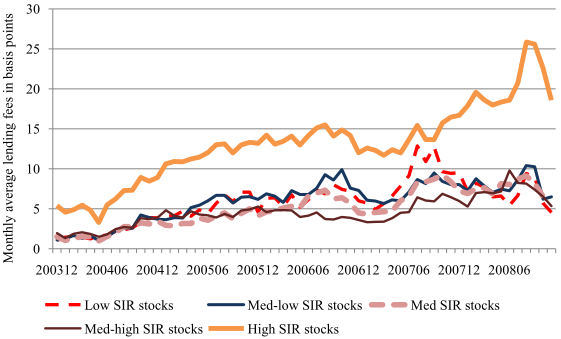

The following chart, taken from the paper, shows average monthly lending (stock borrowing) fees as available by quintile (fifth) sorted on SIR. The average monthly borrowing fee for the highest quintile, within which negative abnormal future returns of heavily shorted stocks concentrates, are typically more than twice those of other quintiles. These fees tend to offset these negative returns both for the stock lenders (who are long) and the stock borrowers (who are short).

In summary, the negative average abnormal returns on heavily shorted stocks found in past studies are mainly due to overlooking the concentration of these returns in stocks with high borrowing costs.

Note that:

- Returns in the study are gross (with one mention of the likely impact of approximate commissions for institutions). Including realistic trading frictions would lower these returns.

- The sample period is relatively short and recent, suggesting the possibility that the market behavior described represents an adaptation to, rather than refutation or refinement of, findings in prior studies.

- Retail investors who do not receive proceeds from loaning their long positions may want to avoid holding heavily shorted stocks.