Are collectibles good long-term investments? In their September 2013 paper entitled “The Investment Performance of Emotional Assets”, Elroy Dimson and Christophe Spaenjers estimate long-term returns for selected collectibles and review the risks associated with such investments. They focus on art, stamps and violins, and also consider wine and diamonds. Using repeat sales histories and catalog prices for aesthetic investments, along with contemporaneous returns for UK equities, UK government bonds/bills and gold, during 1900-2012, they find that:

- Over the sample period, the gross annualized nominal (real) returns for art, stamps and violins are in the range 6.4%-6.9% (2.4%-2.8%). Annualized gross real returns for equities, government bonds/bills and gold over the same period are 5.2%, 1.5%/0.9% and 1.1%, respectively.

- Standard deviations of nominal returns for art, stamps and violins are 13.2%, 13.5%, and 10.1%, respectively, compared to 11.9% for government bonds and 21.6% for equities. However, raw standard deviations underestimate the actual volatility of collectibles returns due to infrequent transactions.

- Pairwise return correlations among collectibles are not large, and those between collectibles and equities are low. However, correlations with prior-year equity returns indicate a relationship between equity market wealth and future prices of collectibles.

- Transaction costs in collectibles markets are high (such as 25% for stamps). Moreover, collectibles bear unquantified storage costs and risks of fluctuating tastes (survivorship bias in return estimates) and fraud.

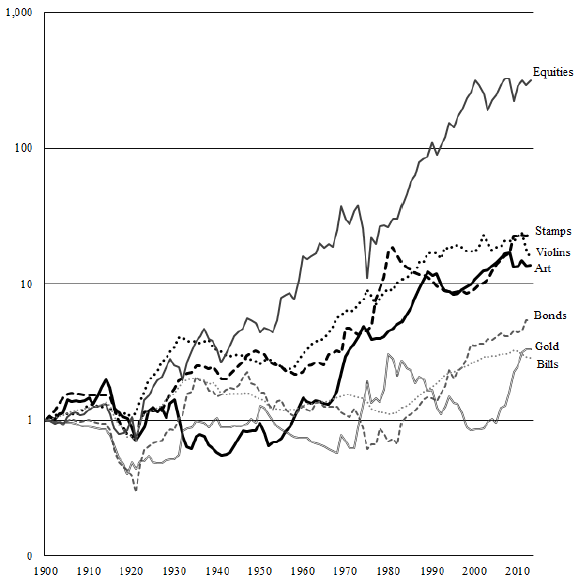

The following chart, taken from the paper, compares gross real cumulative performances of collectibles and financial asset indexes during 1900 through 2012,with each index normalized to 1 at the beginning of 1900.

Collectibles outperform government bonds/bills and gold, but underperform equities on a gross basis. However, the very high trading frictions and other costs for collectibles may offset any gross returns.

In summary, evidence suggests that selected collectibles held over very long periods may be competitive with government bonds and bills, but not equities.

Cautions regarding findings include:

- As emphasized in the paper, the “headline” returns are gross. Including the large trading frictions and other costs involved in buying, holding and selling collectibles may eliminate returns.

- As noted in the paper, the survivorship bias associated with focusing on selected “high-quality” collectibles with long histories (ignoring fad collectibles that continually disappear from the market) may be substantial.

- Acquiring and maintaining an inventory of collectibles representative of the indexes used in the study is beyond the reach of most investors.