Is an art collection a good investment? In the August 2015 version of their paper entitled “Art as an Asset and Keynes the Collector”, David Chambers, Elroy Dimson and Christophe Spaenjers study the performance of an actual buy-and-hold art portfolio, the collection of economist John Maynard Keynes. “Keynes purchased artworks through various channels between 1917 and 1945, and bequeathed his entire art collection to King’s College in Cambridge upon his death the following year. This collection consists of over a hundred pieces by various artists, including Modern Masters such as Braque, Cezanne, Matisse, Picasso, and Seurat, but also friends and acquaintances of Keynes such as Spencer Gore, Duncan Grant, and William Roberts. It has remained intact to the present day.” Using purchase prices/dates, insurance valuations, auction estimates and terminal expert appraisals at the end of 2013 (maximum holding period 96 years), they find that:

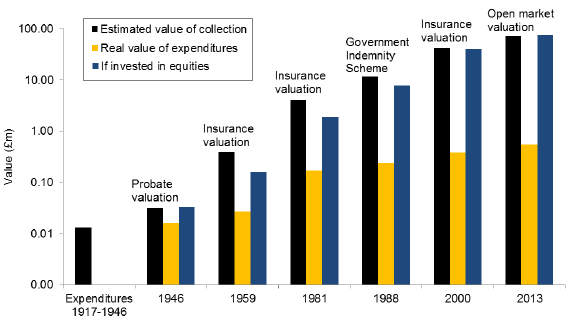

- Over the available sample period, the Keynes art collection has a nominal (real) purchase price-weighted average annualized return of 9.8% (4.7%), close to the total return for equities. (See the chart below.)

- Returns are higher during the decades immediately after purchase, suggesting bargain prices.

- Over the last half century, real annualized real return is about 4.2% (1.8% below the total return on equities).

- Auction purchases have significantly higher initial returns than primary market (galleries and dealers) purchases and lesser-known artist direct purchases.

- The ten most costly items comprise 80% of the initial investment, and appreciation of these items drives the value of the collection. Ancillary analysis confirms that the most valuable artists drive the return of art as an asset class (and value weighting is critical to measuring collection return).

- The stellar performance of one item is material to the return of the collection. Ancillary analysis confirms that art is lottery-like, with positive skewness and excess kurtosis. The typical art investor therefore underperforms the asset class.

The following chart, taken from the paper, shows the total expenditures by John Maynard Keynes on his art collection during 1917-1946 and the estimated values of the collection in 1946, 1959, 1981, 1988, 2000 and 2013 in nominal British pounds. It also shows for the same years the real collection value and the total nominal value of equity investments (including dividends) matched to the art purchases. The purchase price-weighted nominal (real) annualized return on the art collection is is 9.8% (4.7%). The matched equities total return is slightly higher than that of the art collection over the entire sample period. Over the last 25 years, equities have outperformed the collection.

In summary, evidence suggests that an art collector-investor targeting the asset class return must hold a diversified portfolio of relatively valuable works, and still risks falling short by missing an art lottery winner.

Cautions regarding findings include:

- Return calculations for the art collection do not include costs of liquidation (for example, auction commissions). Nor does the return on equities include any frictions for maintaining a liquid portfolio that tracks the underlying country index.

- As noted, reliable capture of the art market return is difficult, especially for small investors.

- The investment horizon in the study is long compared to that of most individuals.