Are premium toys attractive alternative investments? In their April 2018 paper entitled “LEGO – The Toy of Smart Investors”, Victoria Dobrynskaya and Julia Kishilova study LEGO sets as an alternative investment. A secondary market for these sets with 10,000+ daily transactions, affordable to any retail investor, has evolved since 2000. Brickpicker.com tracks prices for each set (either new or used) as the average of its 30 most recent transactions, updated monthly. The authors focus on new sets for comparability with primary market prices. They consider raw prices and construct both a simple diversified index and an hedonic diversified index that accounts for variation in LEGO set characteristics over time (changing themes, set sizes and release years). Using prices from Brickpicker.com since 2000 and from The Ultimate Guide to Collectible LEGO Sets since 1987 for 2,322 LEGO sets across 44 themes through 2015, they find that:

- At the set level over the full sample period:

- Average annual gross returns range from -50% to 600%, with equal-weighted average 18.5% and standard deviation 35.1%.

- Small and huge sets perform better than medium-sized sets.

- Post-2010 seasonal, architectural and movie-based themes offer highest returns.

- At the diversified index level over the full sample period:

- Simple and hedonic indexes are highly correlated (0.95) with similar return distributions, such that the simple index is essentially unbiased.

- Average annual gross return for the simple index is 11% (8% real) with standard deviation 28%, gross annual Sharpe ratio 0.4 and skewness 0.69 (low crash risk). Any discounts available in the primary market would boost average return.

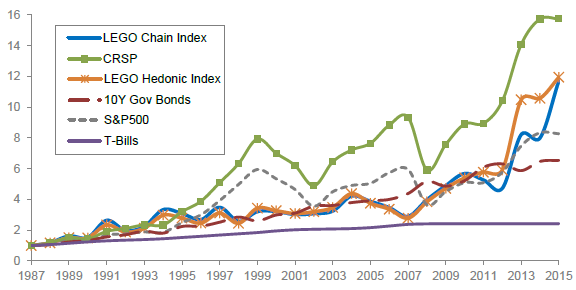

- Over the sample period, LEGO sets outperform the S&P 500 Index, 10-year U.S. Treasury notes, U.S. Treasury bills, gold and other alternative investments (see the chart below).

- Regarding factor exposures, LEGO set returns:

- Have modest positive exposures to U.S. equities market and momentum factors, moderate negative exposure to the value factor and strong positive exposure to the size factor. Annual gross 4-factor alpha is 4.3%.

- Have a slightly negative correlation with 10-year U.S. Treasury note returns.

- Seem immune to U.S. stock market crashes, but not to financial crises in other countries.

- Since LEGO set sales increase steadily despite the global bear markets, with positive simple index returns in 2002 and 2008, they may be a safe haven.

- The above performance data are gross. Trading LEGO sets involves high transaction costs on eBay (9.15% of sale) plus additional market access costs for sellers ($25 monthly). Also, holding LEGO sets may involve storage/safekeeping costs.

The following chart, taken from the paper, plots the simple and hedonic diversified LEGO set indexes and those for a few other assets. CRSP is the broad value-weighted U.S. stock market. Results show that LEGO set indexes are competitive with other asset classes on a gross basis, with portfolio diversification potential.

In summary, evidence indicates that LEGO sets may be an attractive alternative asset for investors with small allocations and very long investment horizons.

Cautions regarding findings include:

- As noted in the paper, the bulk of the sample involves sets released after 2000. Pre-2000 performance data are therefore notional.

- As noted, most results are gross, and trading frictions are so high that net returns may be attractive only to very long-term investors (in which case the sample period is very short).

- Market depth likely supports only retail investors.

- Maintaining LEGO sets in new condition means not playing with them.

For research on other unconventional assets, see this collection.