Does relative demand for crowd-sourced information about a stock compared to other information (such as financial statements and analyst estimates) predict its performance? In their March 2017 paper entitled “Investor Reliance on the Crowd”, Alastair Lawrence, James Ryans, Estelle Sun and Akshay Soni investigate interactions between reliance on crowd-sourced information (Yahoo Finance message board page views) versus other information on individual stocks (via other relevant Yahoo Finance page views) and associated stock returns. They measure reliance as page views for a certain type of information divided by all page views for detailed information about a stock. Using weekly Yahoo Finance page view counts by type of page specific to individual listed U.S. stocks with market capitalizations greater than $50 million during July 2014 through early July 2016, they find that:

- Page views for detailed information on stocks break down as follows: 74% for message boards, 6% for financial reporting, 4% for analyst estimates/opinions and 3% for historical prices.

- Reliance on crowd-sourced information:

- Varies substantially across industries: highest for pharmaceuticals, mining, electrical equipment and precious metals and lowest for textiles, shipping, beer/liquor and business services.

- Tends to be higher for stocks with high return volatility, negative earnings and returns, high bid-ask spreads, high levels of short interest, low analyst coverage and complex financial reporting.

- The largest weekly jumps and drops in reliance on crowd-sourced information are typically the same stocks, indicative of shocks followed by mean reversion. 54% of stocks in the lowest tenth (decile) of weekly changes in reliance are in the highest decile the prior week.

- Stocks in the highest decile of weekly changes in reliance on crowd-sourced information have on average during the next 12 weeks:

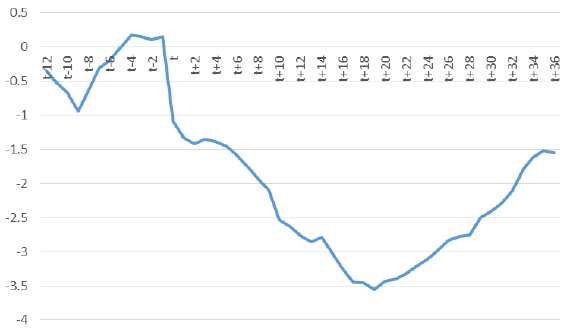

- -1.7% cumulative abnormal (relative to the market) return. This underperformance extends to about -2.5% at week 20, followed by partial reversion through week 36 (see the chart below).

- 42% increase in bid-ask spread.

- 5.2% increase in analyst forecast dispersion.

The following chart, taken from the paper, tracks average cumulative abnormal return of stocks in the highest decile of weekly change in reliance on crowd-sourced information on individual stocks from 12 weeks before through 36 weeks after measurement. Week t is the measurement week. Notable results are:

- -1% drop during the measurement week.

- Further -2.5% downward movement over the next 20 weeks.

- +1% partial reversion after week 20.

In summary, evidence indicates that sharp increases in reliance on (relative demand for) crowd-sourced information about a stock predict material market underperformance over the next four months.

Cautions regarding findings include:

- The sample period is short in terms of variety of market and investor sentiment conditions.

- Reported returns are gross, not net. Trading frictions and shorting costs from exploitation of findings would reduce these returns. As noted in the study, bid-ask spreads (and therefore potentially costs of shorting) tend to be elevated during such trading.

- Information reliance data are not publicly available. Even for those to whom it is available, exploitation is problematic at a portfolio level, requiring a reserve of cash to address opportunities as they unpredictably arise.

- Future return effects are apparently non-linear, concentrating among stocks with the largest weekly increases in reliance on crowd-sourced information. In other words, stocks with big drops in reliance on crowd-sourced information do not exploitably outperform the market.