Does long-term media coverage of a firm exert predictable pressure on its stock price? In the November 2015 version of their paper entitled “Ninety Years of Media Coverage and the Cross-Section of Stock Returns”, Alexander Hillert and Michael Ungeheuer examine relationships between firm media coverage and stock returns. Specifically, they relate long-term New York Times firm coverage/changes in coverage to annual stock returns. Using New York Times news articles, annual returns, trading volumes, firm characteristics for U.S. common stocks with distinctive names (not common words, like Apple), along with U.S. stock market factor returns, during 1924 through 2013, they find that:

- The likelihood that the New York Times covers a given firm in a given year decreases over the sample period, as the nature of business news changes.

- Regarding change in coverage:

- The fifth of stocks with the biggest increase in coverage during a year outperform the fifth with the biggest decrease by an average 10.7% during the same year.

- Change in coverage relates positively to trading activity (turnover).

- Over the next two years, the effect reverses. The fifth of stocks with the biggest past decrease in coverage outperforms the fifth with the biggest increase by an average 5.0% per year.

- A strategy that is each year long (short) stocks with the largest decreases (increases) in coverage one or two years ago, rebalanced monthly to equal weight and normalized to the same volatility as the broad stock market, generates gross annual Sharpe ratio 0.63 over the entire sample period. This strategy:

- Performs especially well during recessions/times of uncertainty.

- Is independent of news tone (positive or negative).

- While not driven by small or illiquid stocks, probably has turnover too high to be attractive on a net basis.

- Regarding level of coverage:

- Level of coverage relates strongly to firm size (correlation 0.44).

- The fifth of stocks with the highest level of coverage outperforms the fifth with the lowest by 1.8% to 3.1% per year over the next three years.

- A strategy that is each year long (short) the quintile of stocks with the highest (lowest) coverage the past year, rebalanced monthly to equal weight and normalized to the same volatility as the broad stock market, generates gross annual Sharpe ratio 0.48 over the entire sample period. This strategy:

- Is independent of news tone (positive or negative).

- While stronger for small and illiquid stocks, probably has a low enough turnover for exploitation.

- Correlation of returns between the change-in-coverage and level-of-coverage strategies is negative, such that they mutually diversify. Specifically:

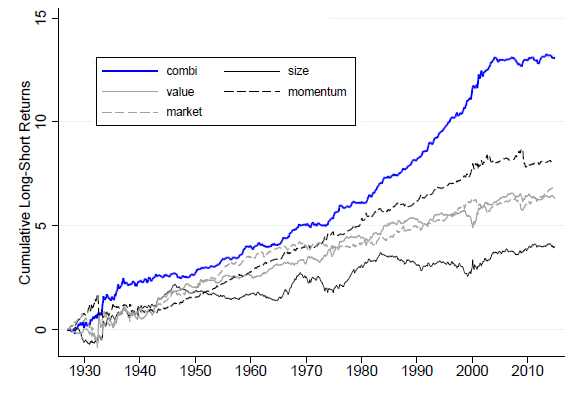

- Combining the two strategies with equal weight generates gross annual Sharpe ratio 0.89 over the entire sample period.

- However, the combination has not performed well since 2000 (see the chart below).

- As noted above, trading frictions are problematic for the change-in-coverage strategy.

The following chart, taken from the paper, tracks gross cumulative performance of equally weighted change-in-coverage and level-of-coverage strategies as specified above over the entire sample period. For comparison, it also shows gross cumulative performances of market, size, book-to-market and momentum factor portfolios over the same period, all normalized to the same volatility as a broad market index. Results show that the combined coverage “factors” outperform conventional factors on a gross basis. The combined coverage portfolios perform particularly well during the 1990s but poorly over the past decade.

In summary, evidence indicates that long-term news coverage (positive or negative) creates price pressure on stocks, some aspects of which may be exploitable.

Cautions regarding findings include:

- Excluding firms with common names may affect findings.

- Monthly rebalancing of long-term strategy holdings to equal weight introduces a potentially confounding size component to test strategies.

- Performance of the level-of-coverage strategy concentrates in the short side of the portfolio and among stocks that may be most difficult to short. Author comments on exploitability appear not to consider costs/feasibility of shorting.