Do U.S. television events that draw large attentive audiences have an effect on the stock prices of main corporate sponsors? In the September 2014 version of his paper entitled “Investor Attention and Stock Prices: Evidence from a Natural Experiment”, Erik Mayer investigates whether main sponsorship of NCAA Division I college football bowl games affects sponsor stock prices during the trading days following the game. Main means that the firm name attaches to the bowl name. He considers three measures of attention: television viewership rating, game score differential (measuring game excitement) and size of competing universities. He uses detailed trading data to determine sources and direction (buy or sell) of trading. Using daily stock prices, trading data and accounting data for 36 publicly traded companies who are the main sponsors of 238 college football bowl games played following the 1991 through 2012 football seasons, and data for the three associated attention measures, he finds that:

- Sampled bowl games have television ratings ranging from 0.4% of U.S. households for the 2007 Insight Bowl to 21.7% of U.S. households for the 2006 Rose Bowl. The average viewership for BCS (Non-BCS) games is 11.1% (3.8%) of U.S. households.

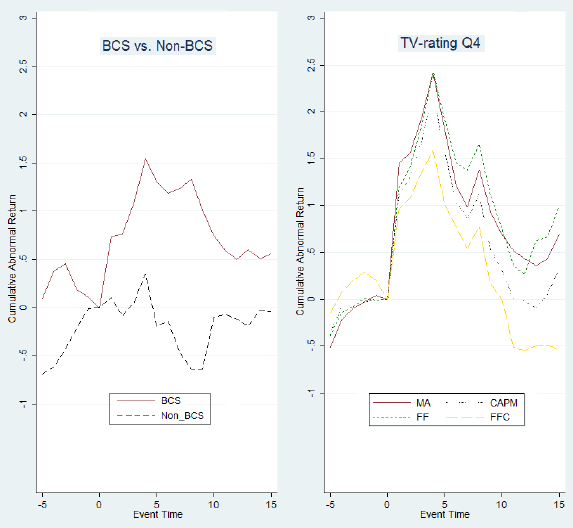

- For the prominent Bowl Championship Series (BCS games), average cumulative abnormal returns for sponsor stocks during the four trading days after games is about 1.5%, followed by an average reversal of about 1% during days five through 15 (see the left chart below).

- For games in the top fourth of viewership ratings, average cumulative abnormal return for sponsor stocks during the four trading days after games is about 2.4%, followed by an average reversal of about 1.4% during days five through 10 (see the right chart below).

- Viewership rating and other attention measures explain the variation in abnormal returns among sponsor stocks on the trading day after the game.

- On average, share turnover for sponsor stocks is abnormally high after games, with small (presumably retail) trades net buyers. On the first trading day after games with above-median viewerships, about 54% (46%) of small trades in sponsor stocks are buys (sells). In contrast, volume imbalance for institutional trades is close to zero.

The following charts, taken from the paper, track average cumulative abnormal returns of sponsor stocks from five trading days before to 15 trading days after college football bowl games over the sample period. Plots are normalized to zero on the last trading day before the game.

The left chart compares three-factor model (accounting for market, size and book-to-market factors) average abnormal returns for BCS and Non-BCS bowl games.

The right plot compares four ways of measuring average abnormal returns for 60 games with the highest viewerships (TV-rating Q4), including: market-adjusted (MA); one-factor model (CAPM, accounting for the market factor); three-factor model (FF, accounting for market, size and book-to-market ratio factors); and, four-factor model (FFC, accounting additionally for the momentum factor).

Results indicate that major bowl sponsorships attract investor attention, on average causing a temporary spike in sponsor stock prices.

In summary, evidence indicates that investors may be able to exploit the major college football bowls via short-term long and then short trades of main sponsor stocks.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for the costs of entering and exiting positions to exploit the bowl sponsorship effect would reduce these returns.

- Per the charts above, much of the average bowl sponsorship abnormal return occurs on the first trading day after games. Investors would likely have to enter positions prior to game day to capture this part of the effect.

- Abnormal returns are averages. Reliably capturing an average effect requires taking positions across many games, such that holdings (capital requirements) may overlap.

- An investor would have to have idle cash to exploit the bowl sponsorship effect, making portfolio-level returns much lower than event returns.