Do changes in Twitter activity about a stock predict its future returns? In their July 2017 paper entitled “Is All that Twitters Gold? Social Media Attention and Stock Returns”, David Rakowski, Sara Shirley and Jeffrey Stark investigate whether Twitter activity: (1) drives noise trading by concentrating investor attention; and, (2) amplifies the effect of fundamental information in news releases. They identify tweets about a stock as those containing a dollar sign ($) before its ticker (such as $AAPL). They focus on daily (midnight-to-midnight) deseasonalized change in tweets, calculated as the residual from a regression on day-of-the-week and month-of-the-year dummy variables. They then test a trading strategy that each day:

- Ranks stocks into tenths (deciles) separately by prior-day change in tweets and market capitalization.

- At the next market open, takes equally weighted long (short) positions in stocks in both the top decile of change in tweets and the bottom decile of market capitalization (the bottom decile of change in tweets and the bottom decile of market capitalization).

- Liquidates positions at the next market close.

- Estimates a characteristic-adjusted open-to-close return by subtracting the return of a portfolio of stocks with similar market capitalizations and book-to-market values.

They restrict their sample to stocks in the Russell 3000 Index at some point during the sample period with: price over $5, at least 24 months of data and tweets on at least 10% of days. Using daily Twitter data, firm characteristics, news coverage and open-to-close returns for the specified sample of stocks during 2011 through 2015, they find that:

- On average, sampled stocks have 9.5 daily tweets, 2.6 daily news articles, market capitalization $7.9 billion and coverage from 9.9 analysts. Tweet activity relates positively to magnitude of characteristic-adjusted daily returns, market capitalization, news coverage, proximity to earnings release, trading volume and advertising expenditures.

- A one standard deviation increase in daily tweets indicates a 0.1% increase in characteristic-adjusted open-to-close return the next day, approximately half of which reverses by the following day.

- This pattern holds after controlling for news releases and other measures of investor attention.

- The effect is strongest for small stocks with high individual ownerships, low prices, high bid/ask spreads, high volatilities and most extreme market betas.

- An increase in daily tweets that accompanies a firm news release amplifies the effect of news on subsequent return, which does not reverse.

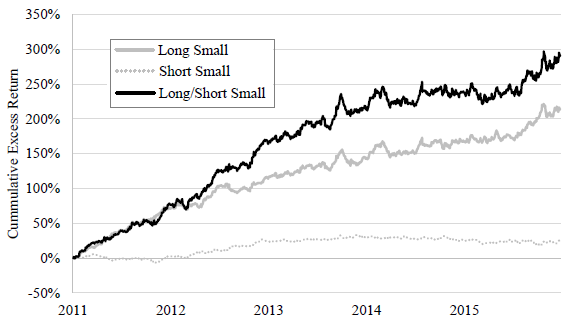

- The long-short trading strategy specified above generates an annual characteristic-adjusted return of 58.1%, accumulating to 291% over the 5-year sample period (see the chart below).

- Gross cumulative characteristic-adjusted return to the long (short) side of the strategy is 214% (25%).

- A similar, simpler long-short strategy based on change in tweets only (ignoring market capitalization), generates 5-year cumulative characteristic-adjusted return 43% (8.6% per year).

The following chart, taken from the paper, tracks gross cumulative characteristic-adjusted returns for the long-short trading strategy specified above (involving stocks in the top and bottom deciles of change in tweets and the bottom decile of market capitalizations), and for its long and short sides separately. Results indicate that:

- The long side drives strategy performance.

- The effect is fairly steady over the 5-year sample period.

In summary, evidence indicates that short-term (1-day) long positions in stocks with the largest prior-day jump in Twitter activity may produce attractive returns.

Cautions regarding findings include:

- The sample period is short in terms of variety of market conditions.

- As noted in the paper, reported results are gross, not net. Accounting for daily round trip trades for each stock and shorting costs would substantially reduce returns. Given the type of stocks traded (small and illiquid), it is not obvious that the strategy is net profitable.

- As noted in the paper, shorting some stocks as specified may not be feasible due to lack of shares to borrow, but the relatively small contribution of the short side mitigates.

- Daily data collection/processing/trade execution as described is beyond the capability of many investors, who would bear fees for delegating the efforts.