How can low-frequency traders save their microscalps from high-frequency traders? In the March 2012 version of their paper entitled “The Volume Clock: Insights into the High Frequency Paradigm”, David Easley, Marcos Lopez de Prado and Maureen O’Hara explore high-frequency trading (HFT) as volume-metered or transaction-metered (rather than time-metered) exploitation of market order processing rules and trading behaviors of others (market microstructure). Low-frequency traders focus on return drivers associated with economic/monetary policy, asset allocation and valuation methods. High-frequency traders fixate on exchange order matching engines, network connections, machine learning, order placement delays and game theory. When market microstructures differ (as for seemingly similar cash and futures equity index markets), HFT strategies differ. Based on relevant research, they conclude that:

- Volume-metered analysis suppresses intraday anomalies (such as open and close), wildness in return distributions (making them more normal) and effects of unusual trades. It also fits capital management (portfolio turnover) better than time metering.

- Over short intervals of time, prices are exploitably predictable artifacts of market microstructure, exactly how exchanges handle order flow and thus execute trades and form prices. HFT evolves to exploit related information “leaks” from low-frequency traders (see the example below).

- Low-frequency traders can adapt (save their microscalps) by:

- Adopting volume-metered analysis where possible.

- Using market structure analysis that assesses the optimal trading horizon.

- Hiding trades during volume bursts (as described in the example below) so that HFT algorithms cannot easily identify them, or using brokers that specialize in searching for liquidity and avoiding a footprint.

- Trading only in exchanges that actively inhibit liquidity-disrupting trading practices.

- Avoiding time-metered trading habits, such as end-of-day hedging, weekly strategy adjustments, monthly portfolio rebalancing and calendar-based contract rolling.

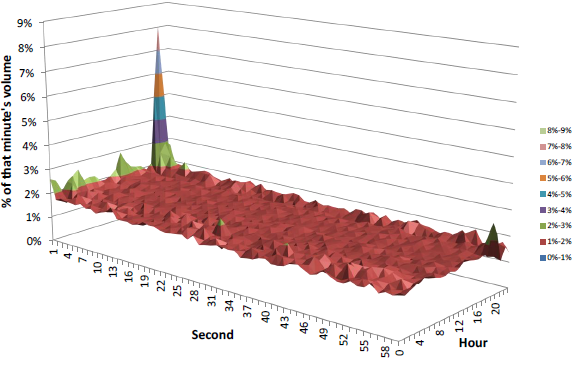

The following chart, taken from the paper, summarizes the relative intensity of trading by volume during a typical minute for each hour for a sample of E-mini S&P 500 futures trades between 11/7/2010 and 11/7/2011. This summary exposes the time-metered trading tendencies of low-frequency traders, with volume concentrating during the first few seconds of round minutes for almost every hour of the day. Concentrations are strongest for 02:00-03:00 GMT (around the open of European equities), 13:00-14:00 GMT (around the open of U.S. equities) and, with an especially high peak of 8%, 20:00-21:00 GMT (around the close of U.S. equities).

Results indicate that large low-frequency traders are time-metering order entry at the beginning of round minutes. Volume-metering high-frequency traders detect and react quickly to such patterns by: (1) evaluating the order imbalance at the beginning of every minute; (2) estimating the side of associated large time-metered orders; and, (3) front-running these orders.

In summary, evidence suggests that low-frequency traders may be able to mitigate microscalping by high-frequency traders by avoiding clock-based predictability.

Cautions regarding findings include:

- Findings are likely immaterial for infrequent traders.

- Unavoidable trading frictions may dominate HFT microscalps for many traders.