Does a factor (style) premium model identify exploitable abnormal corporate bond returns? In their March 2015 paper entitled “Investing with Style in Corporate Bonds”, Ronen Israel, Johnny Kang and Scott Richardson investigate the usefulness of four bond return factors:

- Carry – the fixed spread that must be added to the U.S. Treasuries yield curve such that the discounted payments of the corporate bond match its traded market price.

- Defensive (low-risk) – corporate bond from an issuer with low levels of market leverage (total debt divided by the sum of total debt and market value of equity).

- Momentum – trailing 6-month corporate bond return in excess of the risk-free rate.

- Value – corporate bond with a high carry relative to the issuer’s fundamental distance-to-default (measured via linear regression).

Specifically, they measure the ability of these four factors to explain future excess (negating the role of interest rates) returns of different corporate bonds. They also test exploitability via a long-only portfolio with exposure to the factors. Finally, they check the degrees to which actively managed credit hedge and mutual funds actually exploit the factors. Using monthly data for a broad (but filtered) sample of U.S. corporate bonds/issuers (10,825 bonds and 5,300 issuers) and monthly return data for 213 actively managed credit hedge funds and 218 actively managed credit mutual funds during January 1997 through December 2013, they find that:

- Factor premiums calculated as monthly return differences between extreme quintile hedge portfolios (market value-weighted top fifth minus bottom fifth) reformed monthly by ranking bonds on each factor separately explain nearly 20% of the variation in next-month excess bond returns.

- This explanatory power is robust across subperiods.

- Bond factor premiums generally diversify the bond market premium, the equity risk premium and equity factor premiums.

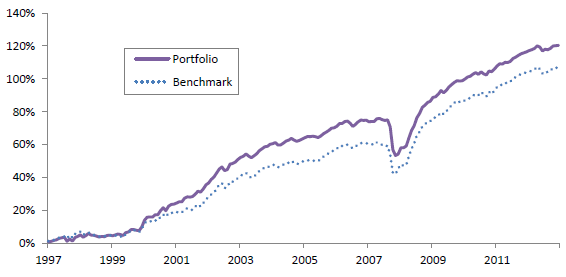

- A long-only corporate bond portfolio that optimally balances exposure to the four factors and trading frictions outperforms a market value-weighted benchmark of all bonds in the sample (see the chart below).

- The optimal portfolio generates an annual average gross (net) excess return of 5.3% (4.7%) with annual volatility 6.0% for a net annual Sharpe ratio of 0.79.

- By comparison, the net market value-weighted benchmark earns an average net annual excess return of 3.7% with net annual Sharpe ratio 0.64.

- Overall results for investment-grade and high-yield subsample portfolios are similar, but factor contributions differ by bond grade.

- Results for a portfolio of European corporate bonds are similar.

- Actively managed credit hedge funds and mutual funds exploit the carry factor, but not the other three bond factors.

The following chart, taken from the paper, tracks cumulative excess returns for the optimized multi-factor long-only portfolio as described above and a market value-weighted average of all corporate bonds in the sample. Linear regression generates an annualized alpha of 1.1% and a beta of 0.99 for the multi-factor portfolio relative to the benchmark.

Outperformance of the factor-based portfolio appears to concentrate during 2000-2002.

In summary, evidence indicates that carry, defensive, momentum and value bond factors may offer exploitable and diversifying premiums.

Cautions regarding findings include:

- The authors note that: “…the trading of corporate bonds is challenging. Thus, we caveat our empirical results by noting that dynamic trading strategies in corporate bonds are not as investable as those in more liquid assets.”

- Individuals generally cannot identify and maintain statistically reliable portfolios of individual corporate bonds and would require an expert manager (a fund), thereby bearing management and administrative fees that would offset alpha to some degree.

- As noted, outperformance of the factor-based bond portfolio appears to concentrate in a relatively short 2000-2002 subperiod.