Do new funds have the latitude to concentrate in the best opportunities while they remain small? In his June 2014 presentation package entitled “How Long Might An Active Bond ETF’s ‘Best Ideas’ Outperformance Window Last?”, Claude Erb compares the performance of the PIMCO Total Return ETF (BOND), an exchange-traded fund (ETF) introduced in March 2012, to that of its parent mutual fund PIMCO Total Return Institutional Class (PTTRX). Using monthly total returns for BOND and PTTRX during March 2012 through May 2014, he finds that:

- Over the entire sample period:

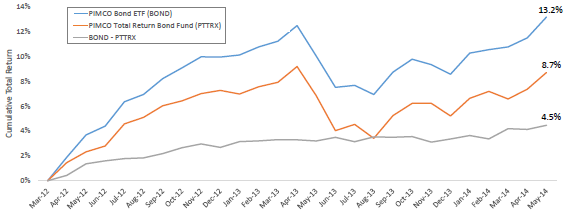

- BOND (PTTRX) generates a cumulative total return of 13.2% (8.8%), for an annualized return of 5.9% (3.9%). Much of BOND’s outperformance concentrates in its first year of existence (see the chart below).

- BOND assets increase from 0.1% to 1.5% of PTTRX assets, with relative growth concentrating in BOND’s first year of existence.

- Because much of the money flowing into BOND misses the initial outperformance, the asset-weighted annualized return for BOND is only 2.6% (compared to 3.0% for PTTRX).

- Results suggest that:

- The small size of BOND at launch lets the fund manager overweight the best ideas of the PTTRX strategy, such that BOND initially outperforms PTTRX.

- After about a year, BOND asset growth exhausts these best ideas.

- Only the earliest investors in BOND accrue its outperformance. Most investors buy high and sell low.

The following chart, taken from the presentation package, tracks the cumulative total return for BOND, PTTRX and the difference in cumulative returns between them. The chart shows that most of the outperformance of BOND relative to PTTRX occurs during the first year of BOND’s existence.

In summary, investors may want to focus on new active ETFs because their managers can concentrate on the best opportunities before asset growth forces compromises in allocation.

An alternative view is that the market soon adapts to anomalies that stimulate introduction of new funds. For related research see “A Fresh Hedge Fund Horse Every Couple of Years?”, “The Outperformance of (Truly) New Hedge Funds” and “New Funds Outperform?”.

Cautions regarding findings include:

- The presentation package is a case study supporting a belief rather than inferential research. The case study approach involves very small samples and potential selection bias.

- The author offers no data on whether a “new fund” strategy offers a steady stream of investments.