Does the Memorial Day holiday signal any unusual U.S. stock market return effects? By its definition, this holiday brings with it any effects from three-day weekends and sometimes the turn of the month. Prior to 1971, the U.S. celebrated Memorial Day on May 30. Effective in 1971, Memorial Day became the last Monday in May. To investigate the possibility of short-term effects on stock market returns around Memorial Day, we analyze the historical behavior of the stock market during the three trading days before and the three trading days after the holiday. Using daily closing levels of the S&P 500 Index for 1950 through 2024 (75 observations), we find that:

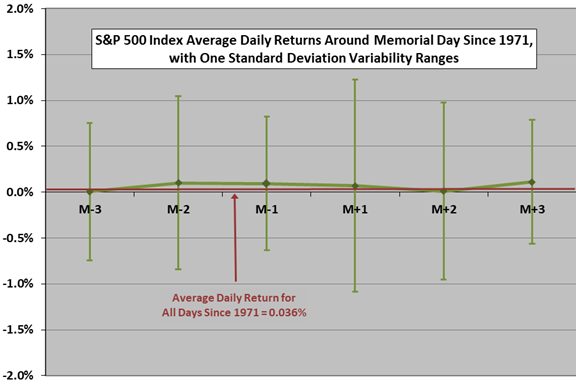

The following chart shows S&P 500 Index average daily returns from three trading days before (M-3) through three trading days after (M+3) Memorial Day during 1971-2024 (54 observations), with one standard deviation variability ranges. The average daily return for all trading days in this subsample is 0.036%.

Results suggest little effect from the holiday.

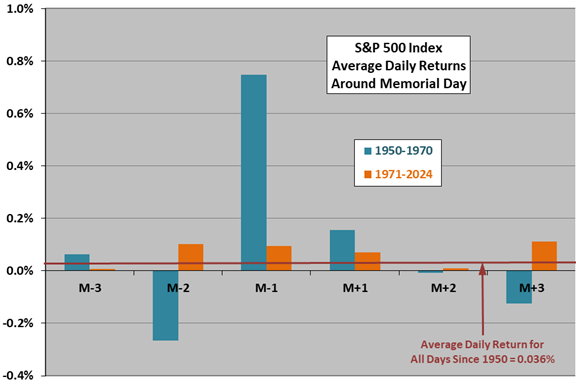

Is there consistency between subperiods before and after the 1971 rescheduling of Memorial Day?

The next chart compares S&P 500 Index average daily returns over the three trading days before and after Memorial Day during 1950-1970 (21 observations) and 1971-2024 subsamples. This chart shows no variability ranges and uses a finer vertical scale than the preceding chart. The most noticeable difference is the large average return on the day before Memorial Day in the older subsample.

In summary, available data offers little support for belief in anomalous U.S. stock market behavior around Memorial Day.

Cautions regarding the finding include:

- Daily returns are small compared to return variability, so experience by year varies widely.

- To the extent that the distribution of daily S&P 500 Index returns is wild, interpretation of the average return and standard deviation of returns breaks down.