Do currency exchange returns exhibit reliable daily patterns? In their March 2012 paper entitled “Intraday Patterns in FX Returns and Order Flow”, Francis Breedon and Angelo Ranaldo investigate currency exchange returns during local trading hours and the balance of the day. They analyze six exchange rates: euro-U.S. dollar; U.S. dollar-yen; Great Britain pound-U.S. dollar; euro-yen; U.S. dollar-Swiss franc; and, Australian dollar-U.S. dollar. Using hourly currency exchange spot bid, ask and execution prices and order flow data for January 1997 through May 2007 (mostly excluding weekends but including holidays) converted to New York time, they find that:

- Currencies tend to depreciate during their respective local trading hours.

- A simple trading strategy that trades currency pairs based on this tendency is not profitable for most pairs because of trading frictions (bid-ask spreads). It is profitable after bid-ask spread for the euro-U.S. dollar pair.

- Order flow pressures confirm this pattern, deriving from a tendency of international investment funds to be net purchasers of other currencies during their own trading hours.

- Data from a single market maker for January 2005 through May 2007 generally corroborates, with banks and investment funds tending to sell their own currencies during local trading hours.

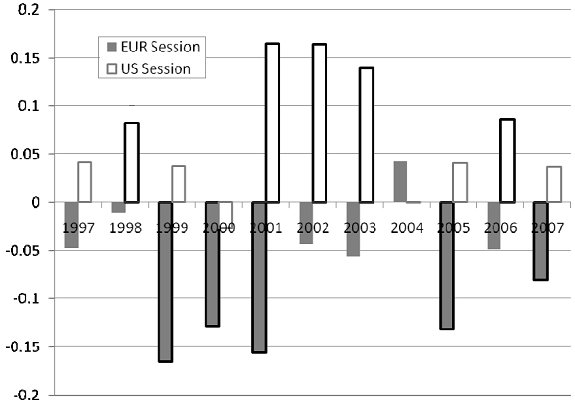

The following chart, taken from the paper, summarizes average gross logarithmic returns by year for the euro-U.S. dollar spot exchange rate, measured in dollars per euro (2007 partial through May, and substituting Deutsche marks for euros prior to 1999). There is a consistent tendency for the euro to appreciate (depreciate) against the dollar during the core trading session in the U.S. (Europe).

In summary, evidence suggests that currency traders may be able to gain an edge by timing buys (sells) of specific currencies with the ends (beginnings) of local core trading hours for those currencies.

Cautions regarding findings include:

- As noted in the paper, the bid-ask spread more than consumes the gross trading pattern, but investors trading for other reasons may benefit.

- The paper does not address broker fees or return on investment for the net profitable euro-dollar trading day pattern

- The end of the sample period is over five years old (about half the sample duration), inviting the question of whether findings persist since May 2007.