Can small (unconnected) investors compete in trades on economic news? In the February 2016 draft of her paper entitled “Is Someone Front-Running You Around News Releases?”, Irene Aldridge examines U.S. stock price, volatility and trading activity around ISM Manufacturing Index and Construction Spending news releases (which occur while the stock market is open). Media violations of embargoes on pre-release distribution of such news, intended to promote widespread simultaneous scheduled release, could influence this activity. She uses average price response of Russell 3000 stocks as a market reaction metric. She considers news “direction” relative either to prior-month value (increase or decrease) or to consensus forecast (above or below). Using one-minute trading data for Russell 3000 Index stocks around monthly ISM Manufacturing Index and Construction Spending announcements during January 2013 through October 2015, she finds that:

- Relative to prior-month levels (see the charts below):

- An increase (decrease) in the ISM Manufacturing Index tends to put moderate upward (strong downward) pressure on average stock price from 30 minutes before to 30 minutes after scheduled release.

- An increase (decrease) in Construction Spending tends to put moderate downward (little or no) pressure on average stock price from 30 minutes before to 30 minutes after scheduled release.

- Relative to forecasted levels:

- An above (below) reading for the ISM Manufacturing Index tends to put moderate upward (somewhat stronger downward) pressure on average stock price from 30 minutes before to 30 minutes after scheduled release.

- An above (below) reading for Construction Spending tends to put a little upward (strong downward) pressure on average stock price from 30 minutes before to 30 minutes after scheduled release.

- In all cases, trading activity ahead of scheduled release is in the right direction so consistently that luck is unlikely.

- The gross value of early information is material. For example, 30 minutes foreknowledge of a new ISM Manufacturing Index value is worth about 1.5 cents per share long (6.5 cents per share short) if the new value is higher (lower) than its previous value.

- Traders seem more influenced by economic variable values relative to prior-month value (increase or decrease) than to consensus forecast (above or below).

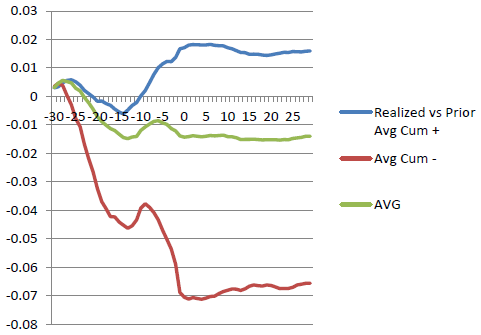

The following chart, taken from the paper, compares average price trajectories of Russell 3000 stocks from 30 minutes before (9:30 AM) to 30 minutes after (10:30AM) scheduled releases of the ISM Manufacturing Index over the sample period (34 releases) for three cases:

- Avg Cum +: new value is higher than that for the prior release.

- Avg Cum – : new value is lower than that for the prior release.

- AVG: all releases.

Results suggest that, on average, pre-release price movements capture most of the net change in average stock price over the entire one-hour window.

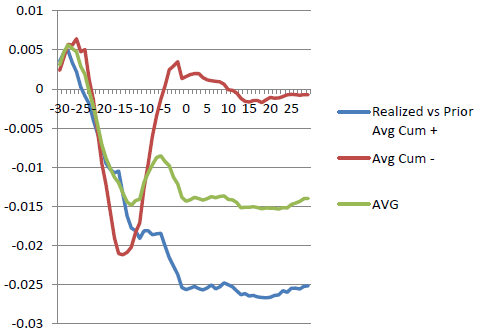

The next chart, also from the paper, compares similar average price trajectories around scheduled releases of Construction Spending. While results are more convoluted than those for ISM Manufacturing Index releases, they again suggest that pre-release price movements capture most of the net change in average stock price over the one-hour window.

In summary, evidence indicates that there may be leaks of embargoed economic news, such that exploitation of the news after scheduled release is not feasible.

Cautions regarding findings include:

- Evidence of news leaks is circumstantial. The study reveals no information about specific leaks.

- The sample period is very short in terms of variety of economic/market conditions. The patterns found may be different in other sample periods.

- The magnitude of effects found may be small relative to trading frictions for some traders.