Do international (seaborne) shipping rates offer advance information about stock market behavior? In the July 2011 draft of their paper entitled “Stock Market Returns and Shipping Freight Market Information: Yet Another Puzzle!”, Amir Alizadeh and Gulnur Muradoglu examine whether changes in the Baltic Exchange Dry Bulk Freight Index (BDI) predict stock market returns and compare its predictive power to that of West Texas Intermediate (WTI) crude oil. To investigate economic significance, they test three trading strategies: (1) a Long‐Short strategy that is long (short) stocks when the next-period return forecast is positive (negative); (2) a Long Only strategy that is long stocks (in U.S. Treasury bills) when the next-period return forecast is positive (negative); and, (3) a Short Only strategy that is short stocks (in U.S. Treasury bills) when the next-period return forecast is negative (positive). Using monthly data for BDI, WTI crude oil price, 13 U.S. stock size/sector indexes, 29 international stock market indexes and economic indicators over the period January 1989 (the earliest consistent BDI meaurement) through December 2010, they find that:

- Over the entire sample period, BDI (WTI crude oil) grows at an annual rate of 1.7% (7.4%), with standard deviation 58.3% (33.3%). BDI is nearly three times more volatile than stock indexes.

- Correlations between monthly changes in BDI and next-month broad size-segmented U.S. stock index returns are in the range 0.21 to 0.24 (0.23 for the S&P 500 Index) over the entire sample period. Those for ten sector indexes are all positive, ranging from an insignificant 0.09 for the oil and gas sector to 0.25 for the financial sector. Correlations for the second half of the sample are much larger than those for the first half, undermining confidence in long-term consistency of relationships.

- In contrast, correlations between monthly changes in WTI crude oil price and next-month U.S. stock index returns over the entire sample period are generally much smaller than those for BDI and statistically insignificant.

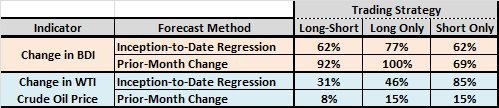

- Trading strategies based on whether the prior-month change in BDI is positive or negative are more effective than those based on more complicated inception-to-date regression forecasting (see the table below). In aggregate, trading strategies based on BDI changes are much more successful than those based on WTI crude oil price changes.

- Predictability is limited to the preceding month, and not persistent at longer lags. In addition, predictability is more pronounced for sectors for which the impact of shipping rate changes is more difficult to infer (and is absent for oil and gas).

- BDI changes generally have very low correlations with economic variables (term spread, default spread and change in industrial production) commonly used to model variations in the equity risk premium. Gradual diffusion of shipping price information to investors in other sectors is the likely explanation of the power of BDI changes to predict stock market/sector returns.

- Results are similar for stock markets in 26 out of 29 other country stock markets. The expected next-month return for the world index after a one standard deviation monthly increase in BDI is 1.1%.

The following table, compiled from data in the paper, shows the percentages of the 13 U.S. size/sector stock indexes for which various trading strategies beat buy-and-hold based on Sharpe ratio (with zero risk-free rate). The three trading strategies are Long-Short, Long Only and Short Only as described above. The two indicators are change in BDI and change in WTI Crude Oil Price. For each indicator, there are two stock index return forecast methods, one based on inception-to-date regression and the other based on whether the prior-month indicator change is positive or negative. Strategy tests assume 0.1% position switching friction.

Results suggest that change in BDI is broadly useful in timing stock size/sector index returns. The very simple prior-month change forecast method is the more effective.

In summary, evidence from several tests on available data indicate that the Baltic Dry Index (at least recently) may have useful predictive power for broad stock market returns and for stock sector (excluding oil and gas) returns.

Cautions regarding findings include:

- The 11-year sample period is short in terms of number of economic cycles. The low correlations of monthly BDI changes with next-month U.S. stock index returns for the first half of the sample amplify this concern.

- Use of three trading strategies, two indicators (BDI and WTI oil price), two trading strategy forecast methods and 13 indexes for economic significance testing invites data snooping. The best and worst results likely overstate reasonable expectations. Moreover, the difference in outcomes for the inception-to-date regression and prior-month change forecast methods undermines confidence in the good performance of the latter.

- Switching friction of 0.1% may be unrealistically low for some indexes and some investors. Use of exchange-traded funds rather than indexes would improve realism. Sensitivity tests of strategy profitability versus level of switching friction would be helpful.

- Statistical significance tests break down when return distributions are wild.

See “Baltic Dry Index as Return Predictor” and “Outperformance Based on Three Macroeconomic Indicators” for related analyses.