Can investors quickly exploit surprising after-hours firm earnings/revenue announcements by trading after hours? In the January 2014 version of his paper entitled “Slow Price Adjustment to Public News in After-Hours Trading”, Jiasun Li investigates after-hours (4:00 pm to 8:00 pm) responses of stock prices to surprising after-hours quarterly earnings announcements. He defines a positive (negative) surprise as neither revenue nor earnings below (above) consensus estimates and at least one of them above (below). He specifies a trading strategy that buys (sells) positive (negative) surprises and holds to the end of after-hours trading. He examines delays between earnings announcement and trade initiation of up to 15 minutes. He calculates returns with actual trade prices, taking into account effective bid-ask spreads. Using (cleaned) tick-by-tick after-hours stock price data for 5,881 surprising after-hours announcements associated with reasonably liquid trading during 2002 through 2012, he finds that:

- With immediate trade initiation (zero delay), the gross average return across all 5,881 surprising announcements is 1.53% within 4 hours. Gross annualized Sharpe ratio is 4.7, and 63% of trades have a positive return. The gross average return for buys (sells) is 1.11% (3.02%).

- A one-minute delay in trade initiation reduces gross average return to 0.72%, with gross annualized Sharpe ratio 2.7 and 61% of trades producing a positive return. Accounting for transaction costs further reduces average return to 0.66% (with net annualized Sharpe ratio 2.5 and 51% of trades profitable).

- Net average returns are still significantly positive even with a trade initiation delay of 15 minutes.

- Under conservative assumptions, an investor could have grown $50,000 at the beginning of 2002 to about $760,000 by the end of 2012 (beating the market by 10% annually). This result assumes:

- If there are simultaneous opportunities, trade the one with the largest analyst following.

- The delay between earnings announcement and trade initiation is one minute.

- Limit position size to the lowest of funds available, dollar volume during the first minute or 5,000 shares (with no price impact from the trade).

- Transaction cost is $0.005 per share.

- Close the position before the end of after-hours trading.

- Results are persistent over time. During the last nine years, all cumulative quarterly returns are positive.

- Tests suggest that the losing counter-parties in these trades are individual contrarian investors.

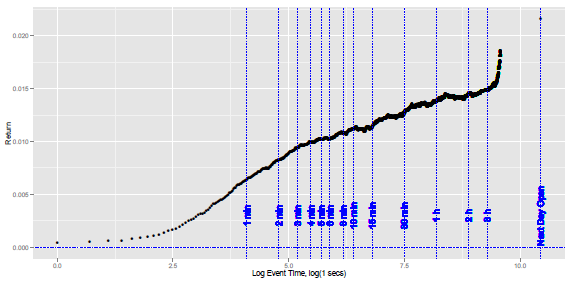

The following chart, taken from the paper, shows average gross cumulative return during after-hours trading for stocks associated with all 5,881 surprising after-hours earnings announcements. The horizontal axis is the logarithm of time commencing one second after the announcement. Component trades are long (short) for positive (negative) surprises. Cumulative return generally increases throughout after-hours trading session, suggesting that traders are not exploiting the phenomenon as tested (no liquidation of exploiting positions near the end of after-hours trading). The next-day open (gap) return shows that the after-hours performance does not immediately reverse.

In summary, evidence indicates that attentive traders with relatively small portfolios may be able to exploit the slow after-hours reactions of other traders to surprising after-hours earnings announcements.

Cautions regarding findings include:

- Liquidating a meaningful position just before 8:00 pm, when volume tends to be extremely low, may be much more difficult than accumulating it earlier during the after-hours session.

- Determining position size per the above trading scenario in real time may be problematic. The assumption that these trades do not impact price is speculative. It seems possible that several traders concurrently competing for the anomalous return could substantially disrupt profitability.

- While the author determines that the sample does not tilt significantly toward heavily shorted stocks, there may still be restrictions on shorting that limit exploitation.

- Some traders may bear transaction costs higher than those assumed.