Is fine wine a good investment? Two recent studies are on the case. In their February 2010 paper entitled “Raise your Glass: Wine Investment and the Financial Crisis”, Philippe Masset and Jean-Philippe Weisskopf examine the risk, return and diversification benefits of fine wine. In their August 2011 paper entitled “Is Wine a Premier CRU Investment?”, Liam Devine and Brian Lucey investigate Bordeaux and Rhone wines as investments. Both studies employ repeat-sales regressions from auctions via The Chicago Wine Company to construct wine price indexes. Using wine auction prices and other sources of wine returns from as early as January 1996, they find that:

In “Raise your Glass: Wine Investment and the Financial Crisis”, the authors construct wine indexes for various regions and price ranges. They assess the return and risk of investment in wine and the diversification benefits of allocating 20% of a portfolio of traditional asset classes to a wine index. Using auction prices for frequently traded wines from several major wine regions around the world during 1996 through 2009 for (more than 400,000 observations over 13 years, involving vintages from 1981 through 2005), they conclude that:

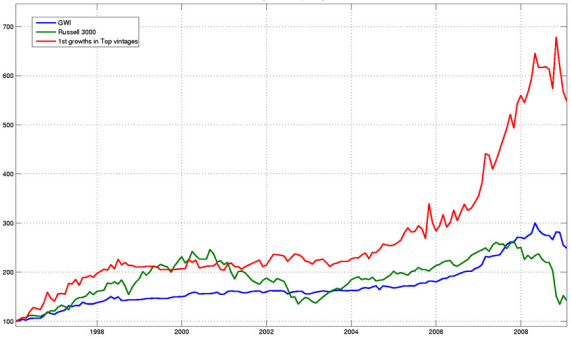

- Fine wine has higher cumulative return and lower volatility than stocks over the sample period, with outperformance concentrated during economic crises (see the chart below).

- Wine price appreciation varies considerably by region, with French regions outperforming others over the sample period.

- Due mostly to the subperiod since 2005, the most prestigious and expensive vintages and estates strongly outperform a broad wine index over the entire sample period.

- The addition of wine as an asset class to a portfolio of traditional asset classes enhances returns and reduces volatility, skewness and kurtosis over the sample period. Enhancements are pronounced during the economic downturns of 2001-2003 and 2007-2009.

- The spread between BAA- and AAA-rated bonds and the dollar/euro exchange rate best explain variation in wine returns, indicating dependence on economic conditions rather than the equity market.

The following chart, taken from the paper, compares the evolutions of a general wine index, first growths for top vintages and the Russell 3000 Index over the sample period. The wine indexes exhibit low volatility compared to the stock market. Top vintages strongly outperform both the general wine index and the Russell 3000 Index since 2005.

In “Is Wine a Premier Cru Investment?”, the authors construct price indexes for Red Bordeaux and Rhone wines and compare these indexes to each other and to the Dow Jones Industrial Average (DJIA), five wine funds and the Liv-Ex Fine Wine 100 (FW100) Index. Using auction prices during January 1996 through January 2007 (about 335,000 observations over 11 years), wine fund return data as available during 2003 through 2010 and FW100 data for July 2001 through June 2011, they conclude that:

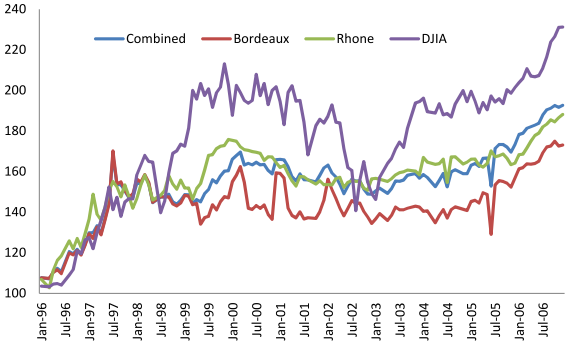

- A combined Bordeaux-Rhone index provides an average annual return of 5.2% over the sample period, well in excess of the contemporaneous yield on one-year Treasury bills.

- While underperforming DJIA based on cumulative return over the sample period, a combined Bordeaux-Rhone index beats DJIA in five of 11 years with much lower volatility. The annual Sharpe ratio for the combined wine index over this period is 0.039, compared to 0.003 for DJIA. The largest annual loss (gain) for the combined wine index is -8.7% (19.2%), compared to -25.3% (26%) for DJIA.

- Performance of Bordeaux sub-regional wines and individual Rhone wines varies considerably, such that investing in narrow wine portfolios appears very risky.

- Returns for the five wine funds exceed that of the combined Bordeaux-Rhone index, but some have high volatilities that may not suit risk-averse investors. The Wine Investment Fund is the top performer, with average annual tranche returns of 13.8% and just 4.14% annual volatility during 2003-2010.

- The FW100 Index indicates a flat market from inception in July 2001 through mid-2005, followed by strong returns over the last five years except for 2008.

The following chart, taken from the paper, compares evolutions of individual Red Bordeaux and Rhone regional indexes and a combined index DJIA during January 1996 through January 2007. The wine indexes underperform over this period on a cumulative return basis, but experience considerably less volatility than the stock index.

In summary, evidence from these two studies suggest that a broad wine portfolio, perhaps tilted toward premium vintages, offers competitive risk-adjusted returns and good diversification properties relative to traditional asset classes.

Cautions regarding findings include:

- The sample period is short for assessment of the relationship between any commodity/collectible for which value depends on economic cycles or stock market bull/bear states.

- The estimated wine indexes are not directly tradable and appear not to account for trading frictions, which are likely higher than those for financial asset markets.

- Performance histories for the wine investment funds are all very short. Valuation of fund holdings may be difficult and therefore somewhat arbitrary. The funds may be much less liquid than stock funds.

- Practical access to this asset class may be limited to large investors.