Do active exchange-traded funds (ETF), which realistically incorporate management costs and trading frictions, offer value to investors? In his June 2011 paper entitled “Active ETFs and Their Performance vis-à-vis Passive ETFs, Mutual Funds and Hedge Funds”, Panagiotis Schizas examines the returns and risks of the first active ETFs, including comparisons with alternative passive ETFs, mutual funds and hedge funds. The active ETFs [and passive counterparts] he considers are:

PowerShares Active Low Duration (PLK) [iShares Barclays 1-3 Year Treasury Bond (SHY)]

PowerShares Active Mega Cap (PMA) [SPDR S&P 500 (SPY)]

PowerShares Active AlphaQ (PQY) [PowerShares QQQ (QQQ)]

PowerShares Active Alpha Multi-Cap (PQZ) [SPDR S&P 500 (SPY)]

PowerShares Active U.S. Real Estate (PSR) [iShares FTSE NAREIT Real Estate 50 (FTY)]

Using matched ETF, mutual fund and hedge fund performance data (daily for ETFs and mutual funds and monthly for hedge funds) as available from active ETF inception (4/14/08 for the first four and 11/21/08 for the fifth) through 3/4/10, he finds that:

- The active ETFs are small in terms of net assets.

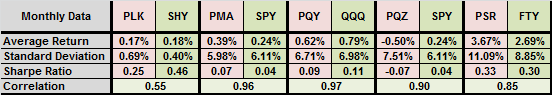

- The active ETFs are not very active, in that they mostly track passive counterpart ETFs fairly closely. Nor do the active ETFs convincingly outperform passive counterparts (see the table below).

- Many active ETFs generate higher average returns than comparable mutual funds.

- Return behaviors of comparable hedge funds tend to anticipate those of the active ETFs.

The following table, constructed independently from monthly data for the above ETFs, compares monthly return statistics for the matched active and passive pairs from inception through June 2011 (39 months for the first four pairs and 32 months for PSR-FTY). The Sharpe ratio calculations are based on the entire available samples and assume that the risk-free rate is zero over these periods. The passive members have higher average monthly returns and higher Sharpe ratios for three of five pairs.

In summary, evidence from limited available samples for matched active-passive ETF pairs do not support a general thesis that the benefits of active portfolio management outweigh the costs.

Cautions regarding findings include:

- Matches between active ETFs and competing funds may be imperfect.

- Depending on the thesis for active management, the sample period may be too short (for example, in terms of number of earnings cycles or bull-bear regimes) for reliable inference.

Note that PowerShares announced on 6/23/11 closure of PQY and PQZ as of 9/30/11.