Do stock analysts elected to All-American (AA) status by institutional voters (via Institutional Investor magazine) reliably out-pick other analysts? In the December 2011 update of their paper entitled “Are Stars’ Opinions Worth More? The Relation Between Analyst Reputation and Recommendation Values”, Lily Fang and Ayako Yasuda examine the average performance of stock recommendations of AA analysts and other analysts as distinct groups. They further differentiate top-rank AAs (first and second place winners) from bottom-rank AAs (third-place and runners-up). They define “strong buy” and “buy” stock ratings as buy recommendations and “hold,” “sell” and “strong sell” ratings as sell recommendations. They focus on distinguishing skill from luck and information value from pure influence. They consider adjustments for five risk factors: market, size, book-to-market, momentum and technology sector. Competing portfolios hold recommended stocks for fixed intervals relative to public release dates with equal recommendation weighting and daily rebalancing. Using analyst recommendation data and associated stock returns for 1994 through 2009 (roughly 3,000 analysts and 20,000 stock recommendations per year), they find that:

- AAs comprise only 8% of all analysts, but account for 12% of all recommendations. Average tenure as an AA is 5.9 years (8.1 years for the top two ranks). While most AAs get elected only a couple of times (which can be due to luck), a minority gets elected repeatedly, and that minority is more likely to attain the top rank.

- Average gross alphas for stock recommendations are significant for all analyst groups, suggesting that recommendations are important information events.

- Based on average annualized, risk-adjusted gross returns:

- An equally weighted portfolio with advance (post-publication only) access to recommendations of AAs outperforms that with advance (post-publication only) access to recommendations of non-AAs by 7% (4%).

- Outperformance of recommendation of AAs holds for both buys and sells.

- Post-publication outperformance derives only from buy recommendations of AAs in the top two ranks.

- The average outperformance of AAs:

- Exists before and after institutional investors elect them and before and after implementation of Regulation FD, contradicting a hypothesis that it is due solely to analyst influence or connections.

- Does not exhibit reversal over the year after public release date, contradicting a hypothesis that it is due solely to luck.

- Outperformance of AA recommendations survives correction for other observable analyst characteristics. In other words, AA status conveys unique information about the performance of analyst stock recommendations.

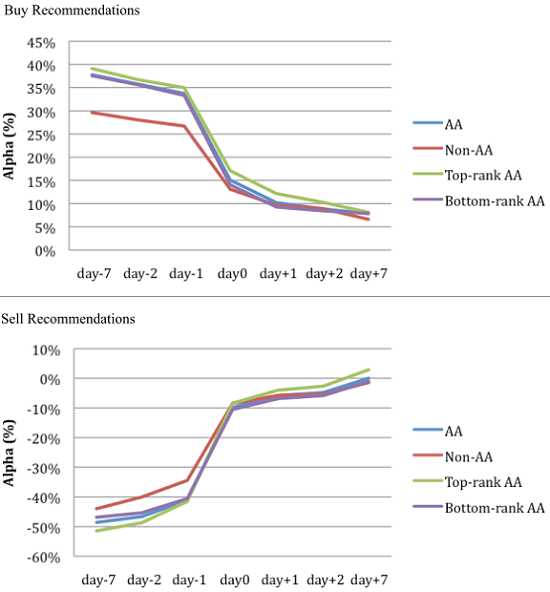

The following charts, taken from the paper, plot the average annualized risk-adjusted gross returns (Alphas) over the entire sample period for portfolios of long (upper chart) and short (lower chart) recommendations of AAs, top-rank AAs, bottom-rank AAs and other analysts (Non-AA) that incorporate recommendations at various points with respect to public release. Portfolios are equally weighted and rebalanced daily. Risk adjustments are for market, size, book-to-market, momentum and technology sector. Recommendation incorporation points range from seven trading days before (day-7) to seven trading days after (day+7) public release. The day0 incorporation point is the close on the public release date. Results indicate that:

- Analyst recommendations are informative at a gross return level, offering average annualized risk-adjusted gross alphas of about 15% (10%) for going long (short) buy (sell) recommendations.

- Advance knowledge (incorporation points before day0) of analyst recommendations would be exceptionally profitable at a gross level. However, recommendations may not exist at all points prior to release.

- Investors must act quickly on recommendations after public release to exploit gross alpha, because alpha decays quickly (disappearing for short recommendations after about a week).

- AA recommendations tend to outperform those of other analysts, with most of the outperformance deriving from buy recommendations by the top AA rank.

In summary, evidence indicates that the stock-picking skills of analysts differ and that All-American status conveyed by surveys of institutional investors represents exceptional skill. Institutions with advance knowledge of analyst recommendations have a notable advantage over other investors.

Cautions regarding findings include:

- As noted, the study reports gross, not net, returns and alphas. Including trading frictions would reduce calculated returns, with cumulative trading frictions for daily rebalancing of portfolios likely substantial. For example, a daily trading friction of 0.01% / 0.05% / 0.1% / 0.2% compounds to an annualized trading friction of roughly 2.5% / 12% / 22% /40%.

- Recommendations may come in clusters, complicating portfolio capital management (dry spells and intervals of too many opportunities). Cash held in reserve for future opportunities would dampen portfolio-level return.