“CFOs vs. CEOs as Inside Traders” describes research finding that, based on data from before the Sarbanes-Oxley Act (SOX), investors should assume that Chief Financial Officers (CFO) are better inside traders than Chief Executive Officers (CEO). Does this finding hold after SOX? In the August 2012 update of their paper entitled “CEOs, CFOs, and COOs: Why Are Certain Insiders’ Trades More Informative?”, Heather Knewtson and John Nofsinger examine insider trading performance of CEOs, CFOs and Chief Operating Officers (COO) spanning SOX implementation. They measure trading performance based on 50-day future returns for overlapping portfolios formed daily to capture executive stock purchases (more informative than sales) unique to category (the other two categories not trading that day) within the past 50 days. They consider both equal and dollar value weightings of qualifying trades. They estimate trading alpha based on a four-factor (market, size, book-to-market, momentum) model of stock returns. They consider subsamples based on pre-SOX versus post-SOX, and CEOs with and without experience as CFO. Using executive trading disclosures, contemporaneous returns for associated stocks and risk factor data during 1992 through 2009, they find that:

- CEO insider trading activity exceeds CFO trading by a factor of nearly ten. In turn, CFOs are about twice as active as COOs.

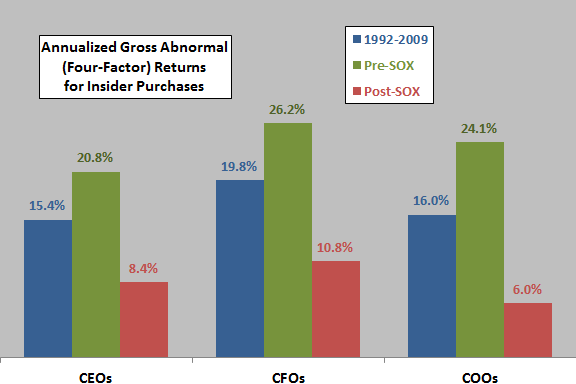

- Over the entire sample period, annualized gross alphas for equally weighted unique purchases by CEOs, CFOs and COOs are highly significant at 15.4%, 19.8% and 16.0%, respectively.

- CEOs with and without prior CFO experience perform similarly, suggesting that executive role rather than CFO-like skills better explains CFO outperformance.

- Alphas decline substantially after SOX implementation for all three executive categories, with the difference between CFOs and CEOs no longer statistically significant (see the chart below). Results suggest that SOX inhibits insider trading, perhaps disproportionately for non-CEO executives.

The following chart, constructed from data in the paper, summarizes annualized gross four-factor alphas for equally weighted insider purchases unique to CEOs, CFOs and COOs over the entire sample period, a pre-SOX subperiod (January 1992 through June 2002) and a post-SOX subperiod (November 2002 through December 2009). Results indicate that: (1) CFOs are the best traders among the three executive categories; and, (2) SOX substantially inhibits insider trading.

In summary, evidence suggests that investors are better off mimicking CFO rather than CEO or COO insider trades, but the Sarbanes-Oxley Act has substantially reduced the historical informativeness of insider trading.

Cautions regarding findings include:

- Reported alphas are gross, not net. Including reasonable trading frictions for investors mimicking insider trades would lower these alphas.

- Alpha calculations use trade dates, not disclosure dates. Investors tagging along may miss a material part of reported alphas, but less so during the post-SOX subperiod (SOX requires disclosure within two days of trades, while prior regulations required disclosure by the tenth day of the following month).