Which consensus forecast of U.S. economic indicators is best? How does the U.S. equity market react to consensus forecast errors? In their April 2012 paper entitled “Market Reaction to Information Shocks: Does the Bloomberg and Briefing.com Survey Matter?”, Linda Chen, George Jiang and Qin Wang investigate the accuracy of, and equity futures market reactions to, competing Bloomberg and Briefing.com survey-based forecasts for the values of scheduled weekly, biweekly, monthly and quarterly economic announcements. They focus on 14 announcements commonly treated as important: Building Permits, Capacity Utilization, Case-Shiller 20-city Index, Consumer Confidence, Consumer Price Index, Durable Goods Orders, Existing Home Sales, GDP Advance, Leading Indicators, Non-farm Payrolls, Personal Spending, Producer Price Index, Retail Sales and Unemployment Rate. They introduce standardization to compare errors across different indicator scales. Using consensus forecasts and announced values of 59 economic indicators, along with contemporaneous high-frequency price and volume data for the nearest S&P 500 futures contract (as available), over the period January 1998 through August 2010, they find that:

- Announcements cluster at 8:30 AM ET and 10:00 AM ET.

- The number of expert inputs to consensus forecasts varies, ranging as high as 80 for Bloomberg surveys of important announcements such as Consumer Price Index and Retail Sales. Briefing.com surveys generally involve fewer inputs, in 20s. Reported consensus forecasts compile up-to-date inputs available the week before announcements.

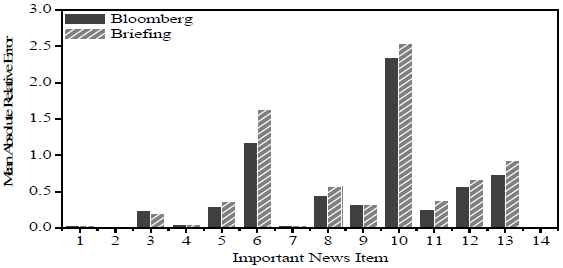

- While neither service exhibits systematic bias (non-zero mean error), the Bloomberg consensus forecasts have slightly smaller mean absolute errors than those from Briefing.com, especially for important announcements such as Consumer Price Index, Durable Goods Orders, GDP Advance, Personal Spending, and Retail Sales (see the chart below).

- Announcement surprises relative to both consensus forecasts significantly affect S&P 500 futures returns, return volatilities and volumes during 5-minute, 15-minute and 30-minute post-announcement intervals. Surprises relative to Bloomberg forecasts generally have higher explanatory power than those relative to those from Briefing.com.

- The market often reacts asymmetrically to positive and negative announcement surprises. In particular, the market reacts very negatively to positive shocks in Consumer Price Index and Producer Price Index and negative shocks in Case-Shiller 20-city Index, Personal Spending and Retail Sales. More specifically:

- For Capacity Utilization, Case-Shiller 20-city Index, Non-farm Payrolls and Personal Spending, the market responds negatively to negative surprises (but not positively to positive surprises).

- For Consumer Confidence and Consumer Price Index, the market responds significantly to positive shocks, positively for the former and negatively for the latter. However, the market does not respond significantly to negative shocks for either indicator.

- For GDP Advance, Leading Indicators, and Retail Sales, the market responds positively (negatively) to positive (negative) shocks. For the Producer Price Index, the market responds negatively (positively) to positive (negative) shocks.

The following chart, taken from the paper, summarizes mean absolute relative errors (average of absolute forecast errors divided by announcement value) for Bloomberg and Briefing.com consensus forecasts of 14 important economic announcements: (1) Building Permits, (2) Capacity Utilization, (3) Case-Shiller 20-city Index, (4) Consumer Confidence, (5) Consumer Price Index, (6) Durable Goods Orders, (7) Existing Home Sales, (8) GDP Advance, (9) Leading Indicators, (10) Non-farm Payrolls, (11) Personal Spending, (12) Producer Price Index, (13) Retail Sales and (14) Unemployment Rate.

Results indicate that Bloomberg consensus forecasts are slightly more accurate than Briefing.com consensus forecast for most indicators.

In summary, evidence indicates that the Bloomberg consensus forecasts of economic indicators are more accurate than those from Briefing.com and that investors may be able to exploit some surprises relative to these forecasts via short trades.

Cautions regarding findings include:

- “Significance” in this study means statistical, not economic. The study does not address exploitation of announcement surprises.

- Return calculations in the study are gross, not net. Including trading frictions would lower reported returns.

- Maintaining idle capital while no announcement surprises are available would affect long-term portfolio-level return.