How do pension funds, arguably representative of sophisticated and conservative investors, use real estate as an alternative investment? In their January 2012 paper entitled “Value Added From Money Managers in Private Markets? An Examination of Pension Fund Investments in Real Estate”, Aleksandar Andonov, Piet Eichholtz and Nils Kok investigate the allocation, costs and performance of pension funds with respect to real estate investments. Using self-reported investment data for 884 U.S., Canadian, European and Australian/New Zealand pension funds during 1990 through 2009, they find that:

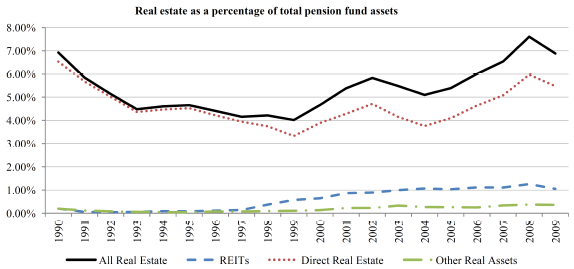

- Real estate is the most important asset class after equity and bonds, representing on average 4% to 7% of pension fund assets over the sample period (see the first chart below). About 75% of funds invest in real estate.

- Direct real investments dominate positions in Real Estate Investment Trusts (REIT) for pension funds. Large funds are more likely to invest in REITs. Small funds seem not to recognize that REIT returns match those of externally managed direct holdings and beat those of funds-of-funds, but at much lower cost.

- Pension fund allocations to real estate are predominantly active (adjusted tactically) rather than passive.

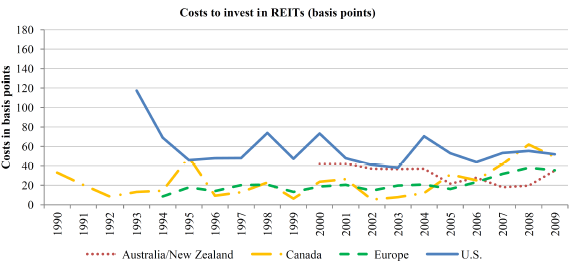

- The average cost to pension funds of investing in real estate is 0.76% per year, higher for direct investments (0.83%) than for REITs (0.41%). See the second chart below. Real estate investment costs are signi cantly lower than those for private equity and hedge funds.

- Over the entire sample period, the average annual gross return to pension funds from real estate investments is about 7%, with REITs (10.9%) outperforming direct investments (6.7%). Funds-of-funds substantially underperform alternatives by over 2% per year due to multiple layers of fees.

- Pension funds exhibit strong persistence in real estate investment performance, mainly due to direct real estate investments. There is no persistence in REIT investment performance, suggesting lack of informational advantage for that category.

The following chart, taken from the paper, summarizes average pension fund allocation to real estate investments during 1990 through 2009, with a breakdown into direct holdings and REITs. The overall average allocation across all years is 5.4%. Though presenting higher investment costs, direct real estate holdings dominate, perhaps because of potential informational advantages.

The next chart, also from the paper, tracks the average pension fund cost for investing in REITs by geographical region. Costs for investing in REITs are much lower than those for direct real estate holdings and funds-of-funds.

In summary, evidence from pension fund holdings suggests that modest allocations to REITs may be a cost-effective way to maintain exposure to real estate as an asset class.

Cautions regarding findings include:

- Individual investors may hold leveraged (mortgaged) direct real estate positions via homes that are much larger than the average allocations described above, thereby obviating the need for further exposure to real estate.

- As noted in the paper, return estimates do not account for any performance fees due to external managers. Such fees would reduce reported returns.

- The sample period is not long in terms of demographic and policy pressures.